The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 1

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 3

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 24

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 17

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

- Foreclosure 1

- Formidium 1

- Fund Management 5

- Funds 2

- IRA 1

- IRA Club 1

- IRS 1

Access Our Exclusive Investment Insights.

Dive into Private Investment Due Diligence with a Guided Tour of the PPM

Identify key aspects of a and define what fits your investment goals so you can pull that information quickly from the document and determine if you need to read further. Get to the “No” quickly so you can move to a better opportunity.

Watch Chris Carsley walk you through the private placement memorandum and the due diligence it requires to invest with confidence.

Alternative Investments: Due Diligence Red Flags

Kirkland Capital Group Chief Investment Officer Chris Carsley’s paper, Alternative Investments: Due Diligence Red Flags, was published in the prestigious CAIA Blog, Portfolio for the Future. This paper provides important, and accessible, education to investors on how to identify and vet certain red flags during the pre-investment due diligence process.

4 Factors to Help You Avoid a Disappointing Private Alternative Investment

Private alternative investments are a powerful way to build your wealth. However, like other powerful tools there is risk if the user manual is not read, and the proper precautions are not taken before using. Understanding how to look at the selection of tools available, assess, and select the right one for your need is critical. Good ones build and protect your wealth more efficiently; the wrong one can do much harm to your wealth (and even your health).

In this webinar hosted by Verivest, alternative fund expert Chris Carsley and his partner at Kirkland Capital Group, Brock Freeman, walk through four important areas to equip you in assessing a private alternative investment fund. The documents (the fund’s “user manual”), fees (what will you be charged), fund operation risk (can hackers steal your money), and transparency (or do you know what your fund manager is really doing with your money).

Dr. Adam Gower’s DEAL TIME! Interview

Watch or listen as Dr. Adam Gower interviews Chris Carsley & Brock Freeman about Kirkland Capital Group's Bridge Finance Debt Fund investment opportunity.

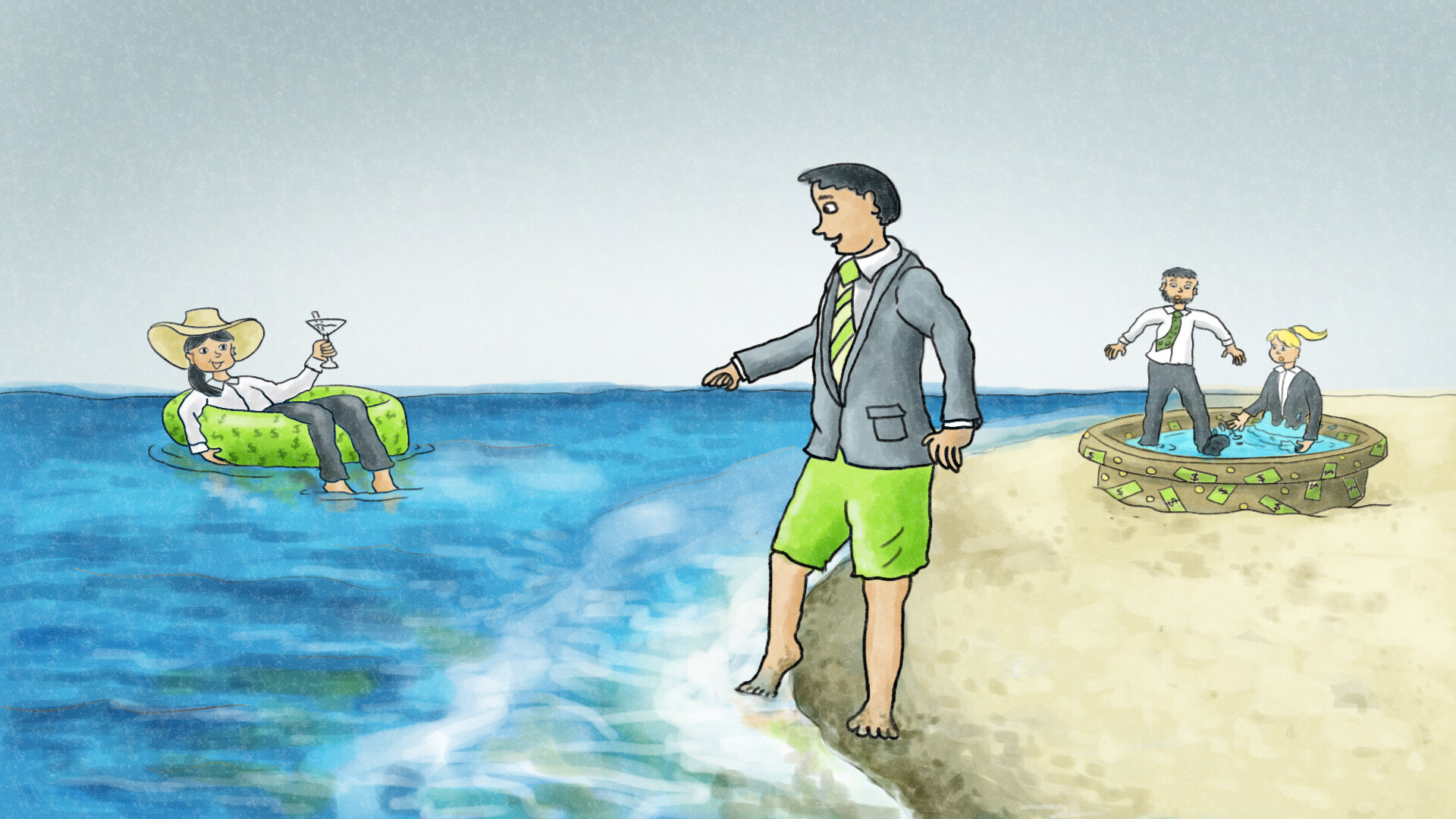

3 Ways the Rich Get Richer with Private Alternative Investments, and How You Can Too

As a newly qualified accredited investor, you may be asking yourself “what is the next step for my investment portfolio?”

Let’s look at two university classmates, Annie and Tom, who have had similar successful tech industry roles, similar household income, and comparable living costs. It’s now the future and both are turning 50 this year. Annie is, along with her spouse, retiring this year as they have enough income from investments to replace the income from their jobs; they are financially independent. Tom and his spouse, on the other hand, are making standard progress in their retirement investments, but are years away from having enough investment income to retire.

Scott Jensen: Financial Planner for Real Estate Investors

In this interview we talk with Scott Jensen, CFP, the founder of Renovate Financial Planning. What makes Scott and Renovate unique is they specialize in working with Real Estate Investors.

He wakes up every day excited to get to work because he combines the career he loves, financial planning, with his side-gig of real estate investing. It’s difficult, as a Real Estate Investor, to find an advisor who understands real estate or who won’t advise you against it because they lack understanding of this important Alternative asset class. As a Real Estate Investor himself, and an avid researcher on all things real estate and financial planning, he is uniquely able help Real Estate Investors reach their financial and real estate goals.

Understanding “Micro-Balance” Bridge Lending

Most lenders do not consider commercial real estate bridge loans under $1M. That’s where Kirkland Capital Group enters the picture. They’ve leveraged this opportunity by building the Kirkland Income Fund, delivering a “micro-balance" commercial mortgage option. Chris Carsley and Brock Freeman of Kirkland join Lance to talk about the ins and outs: how the Fund offers investors lower risk and consistent annual fixed income returns, how they approach the underwriting process, commercial mortgage brokers, and assessing borrower risk.

Tap into Retirement Plan Dollars for Alternative Asset Investing

Hosted by CAIA Seattle, John Paul Ruiz of The Entrust Group shows how you can unlock the power of retirement plan capital for investing in alternative investments. There are 33 trillion dollars in retirement plans. Whether you are an advisor helping clients or an individual investor learn about the platforms available, rules and regulations, and how to get started in a broader utilization of your retirement plan assets.

Pharos: Data Library of the Future

A “fireside chat” style interview with Kelly Hill, the CEO of Pharos, about the ideas behind this platform and how this will change the way data is bought, sold, and shared.

CAIA Webcast: Private Credit and Why it’s a Safe Harbor in Tumultuous Times

Hosted by CAIA Seattle and CAIA San Francisco, this panel discussion explored how the impact of COVID-19 on the global economy has affected the opportunity set across the private credit landscape. It discussed how private credit strategies, including private real estate debt, have navigated the current environment and the impact experienced with deal flow, yield expectations, and perceived investment safety. The panel also explored why private credit as an asset class can still offer a safe harbor even in these tumultuous times and their post-COVID outlook for continued investment opportunities. Speakers represent the views of allocators to private credit as well as those actively managing debt portfolios.

2021 March—Rising Optimism 💪🏼

Investor Interview: Li Tan

In this interview we talk with Li Tan, CPA. Li is a finance and accounting professional with over twenty years of experience in the manufacturing, technology and real estate industry. We discuss her background in political science, finance, and accounting, and how this has influenced her career and investment approach. She also explains her involvement in real estate investment and why she invested in the Kirkland Income Fund.

Kirkland Capital Group approved as a Verivest Verified Gold Sponsor

Kirkland Capital Group is happy to announce that we are officially a Gold member of the Verivest Sponsor Network! We are committed to trust and transparency, helping you invest your hard-earned money with peace of mind.

8 Factors to Determine If an Investment Fund Manager Is Putting Investors First

Lots of managers say, "Investor First," but it is only when you dig into the fund documentation and really spend time understanding the management team, fees, and fund details can you better assess if this is the case. Regardless of the investment platform, here are eight factors for investors to consider when reviewing fund managers to see if they are putting investors first.

2021 February—Are We Seeing Stabilization?

National vacancy rates were 4.5%; but net absorption of multifamily units was clearly weaker than last year. Many suburban and smaller markets have seen rent increases.

Are Real Estate Debt Funds a Replacement for Bonds?

In this live online interview Chris Carsley and Brock Freeman talk with Brandon Walsh at Rocket Dollar about alternative investments, the death of the sixty forty or at least the lower interest rate bond market's impact on the low-risk part of your investment portfolio, what to look for risk-wise when exploring private investment funds, what we have done to lower operational risk and be transparent with our Kirkland Income Fund, and much more.

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

Not yet ready to go direct with Kirkland Capital Group? You can still invest 👌

Does this sound like you: I’d like to take advantage of the higher returns and lower risk of passive real estate investment; however, I’m not ready to commit the required amount of money for a year to a private real estate investment fund.

The good news, you have a choice.

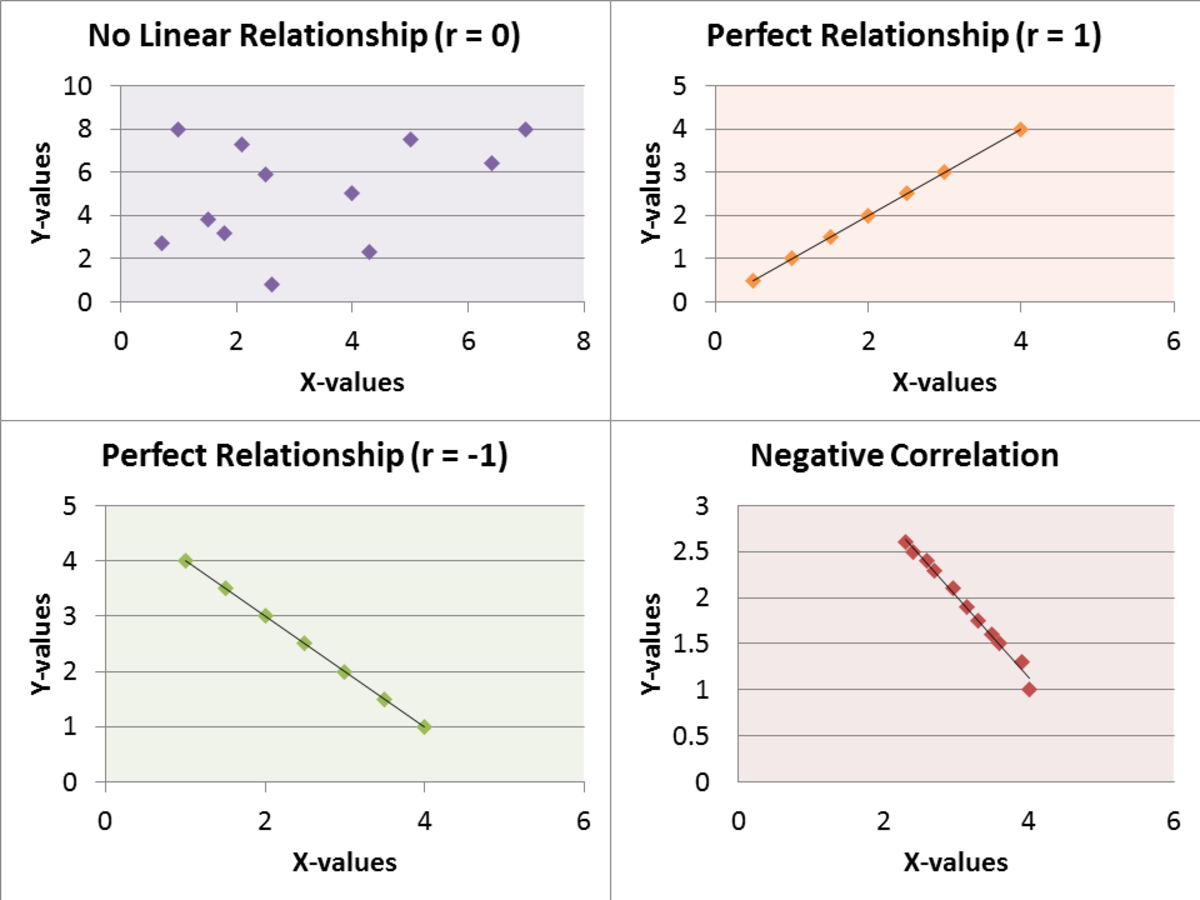

Correlation and the Impact on an Investment Portfolio

How do I know if my investments or the ones I intend to include to my portfolio would help diversification? It is simple – understand the relationship between the investments.

2021 January — Are Alternatives the Answer to Avoiding the Bleak Outlook for Stocks & Bonds?

Research firms in Wall Street have expressed concerns for lower returns for both fixed income and equities in 2021. Credit and emerging market debt remain brighter spots, but increasingly it is to alternative assets investors must turn to find higher returns.