Correlation and the Impact on an Investment Portfolio

Correlation

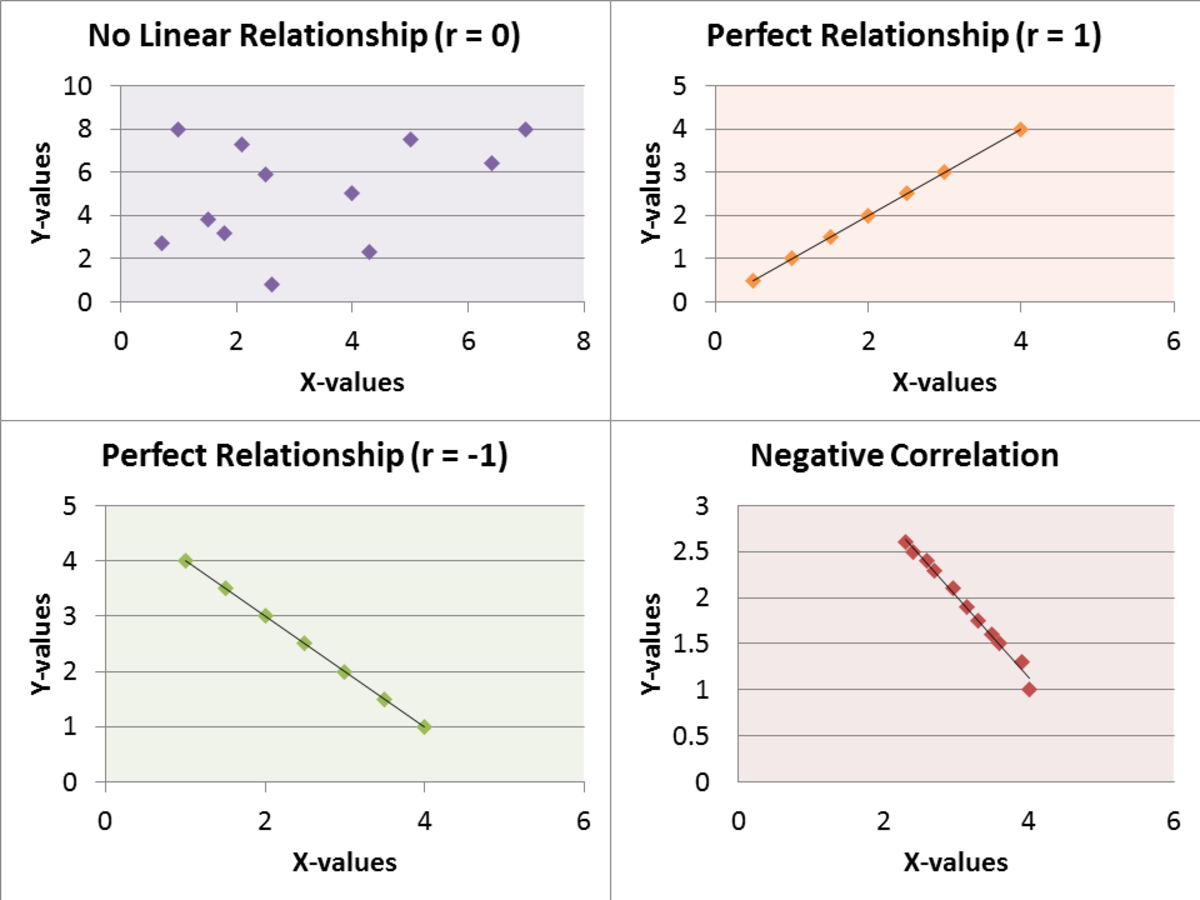

Definition: A statistical measure calculating the degree of how two variables (Investments) relate to each other A calculation that shows the level of relationship from -1 to +1. A positive correlation simply implies that a particular investment moves in the same direction or similarly like the other variable in a variety of magnitudes, based on how much close it is to 1.

What’s the significance of this? If you’ve been reading up on investments, virtually all the articles are hammering on diversifying your portfolio given the uncertainties that lie ahead of us. However, we like to know what diversification really implies in this context. How do I know if my investments or the ones I intend to include to my portfolio would help diversification? It is simple – understand the relationship between the investments. Have both investments gone the same way or in different directions as specific events happen within the market, and how far did the investments move with respect to one another. Sometimes, understanding this could be complicated, particularly when you have several investments inside one portfolio. Historical return data for a variety of assets is generally available and you should be able to dive in and make some comparisons.

Your investment advisor should also be able to provide some insights. One important note is do not just look at correlations generated from long term historical data as this can be misleading if viewed in isolation. Be sure to understand how your investments correlate in stress periods as well.