Kirkland Income Fund Impact Metrics

Through the Kirkland Income Fund, Kirkland Capital Group (KCG) originates commercial mortgage bridge loans for investors and owner-users primarily in secondary and tertiary markets.

The loans range in size from $200K to $1.5 million. These loans enable the borrower to purchase a property, or make improvements to a property in an effort to stabilize the property financially, and then be able to obtain long-term financing. These loans empower borrowers to enhance their wealth and communities by improving properties, revitalizing neighborhoods, and strengthening the local fabric. KCG has the networks and ability to continue sourcing loans and servicing these smaller markets, and that is the key inefficiency that KCG is capturing and will continue to capture for the fund’s investors.

We are able to track a number of metrics that show how we’ve impacted the communities we lend to and they are detailed below.

INCOME

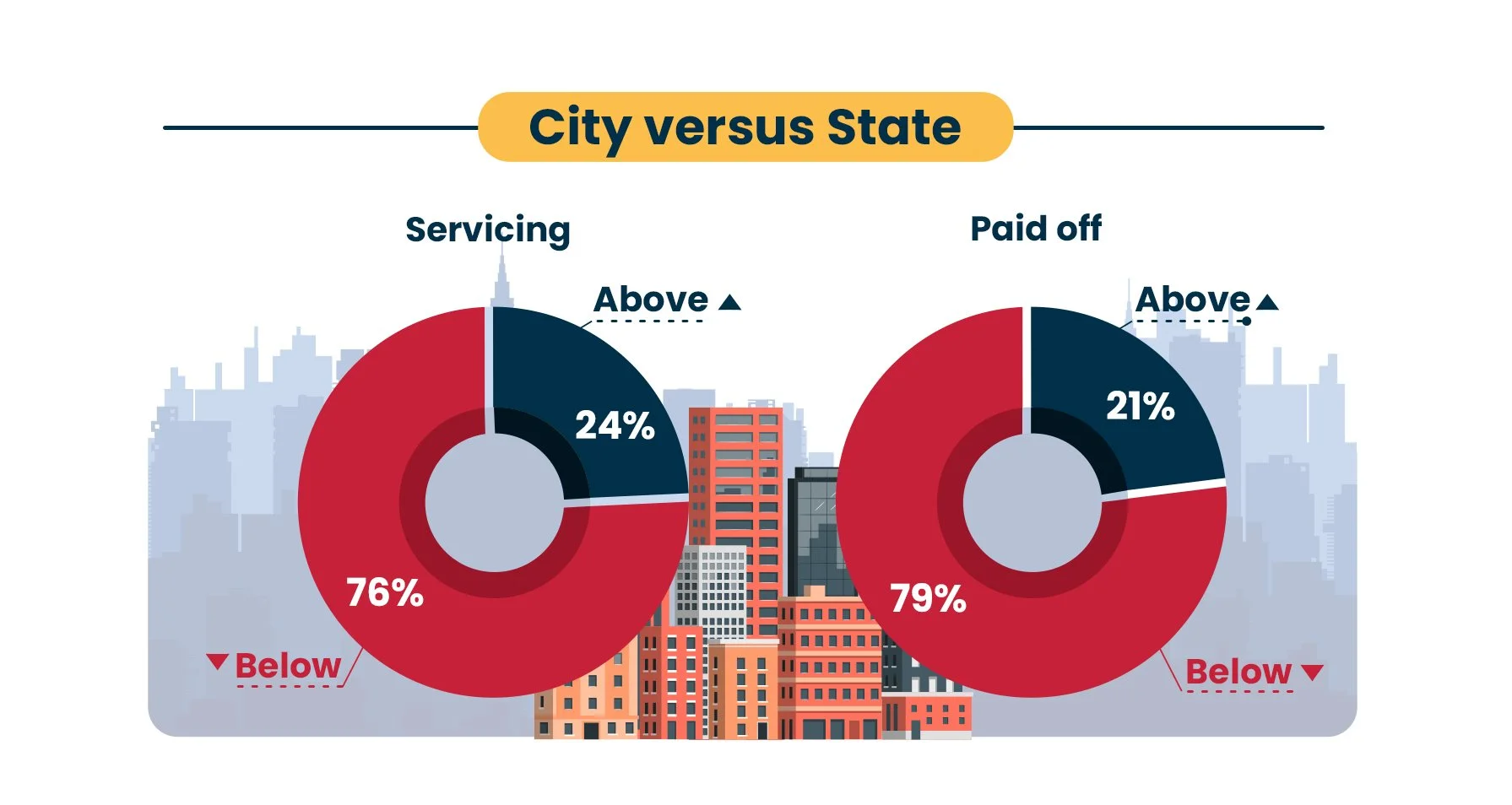

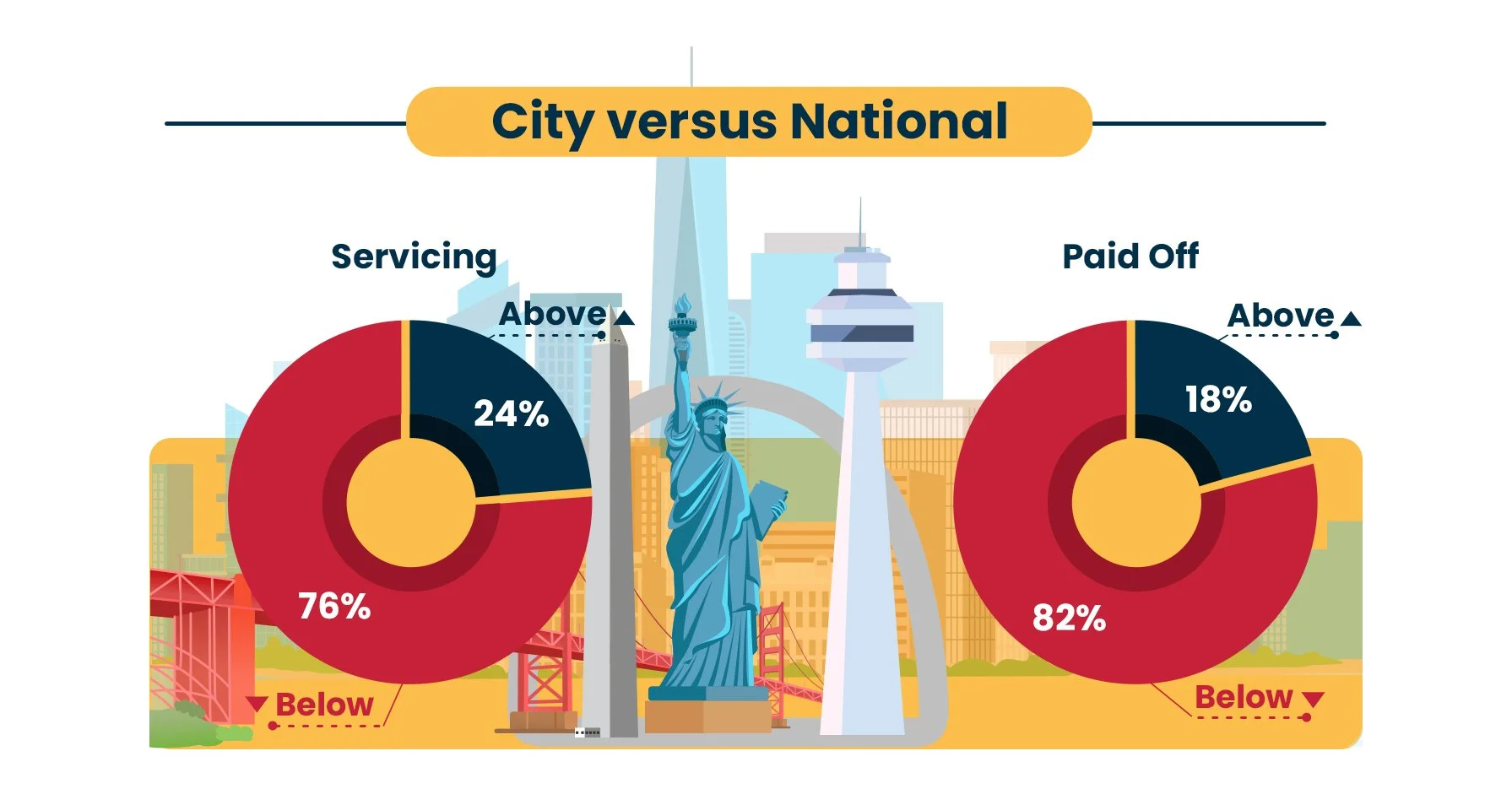

Average median household income in the lending areas against the state and national average

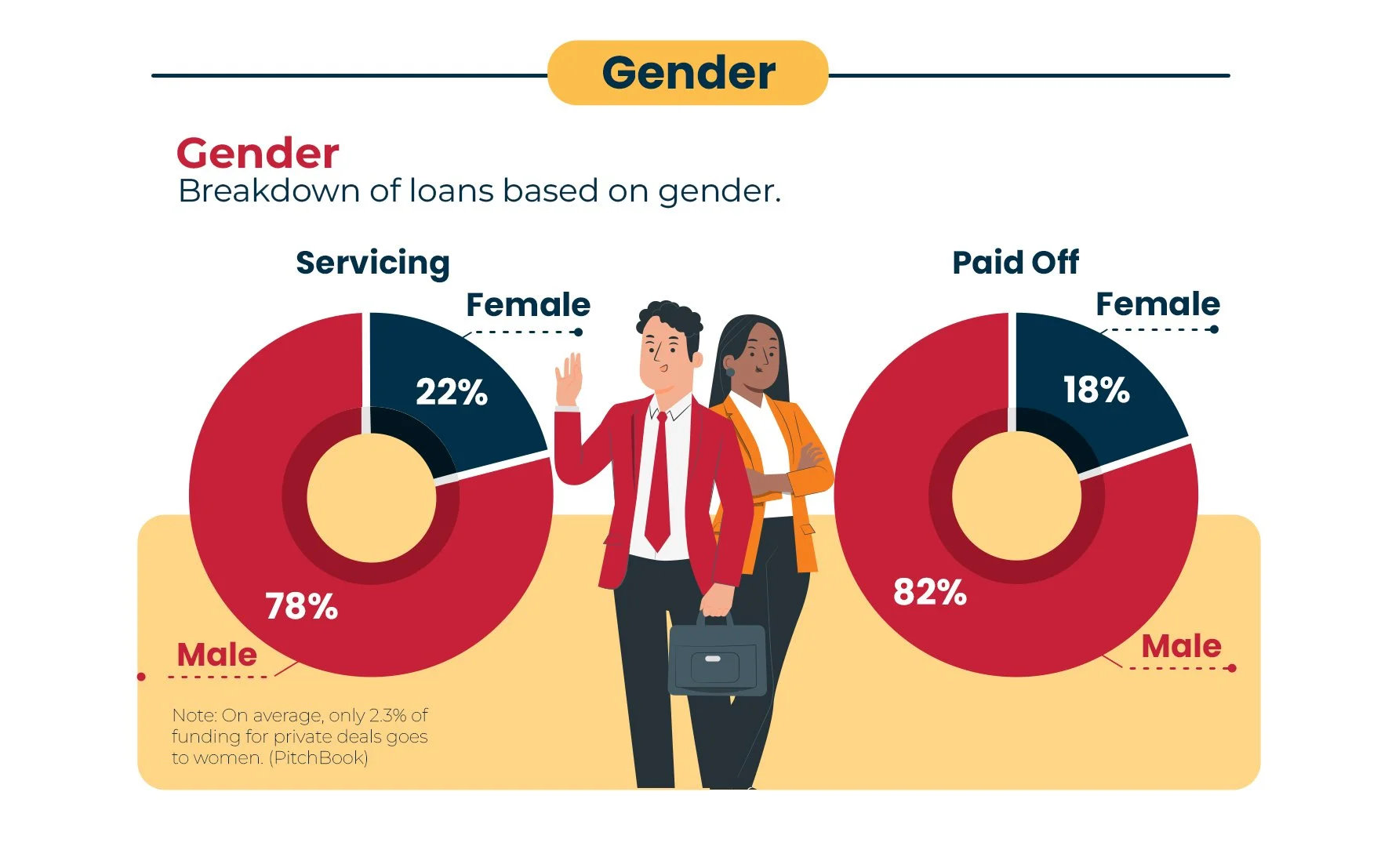

Gender

Breakdown of Loans based on Gender

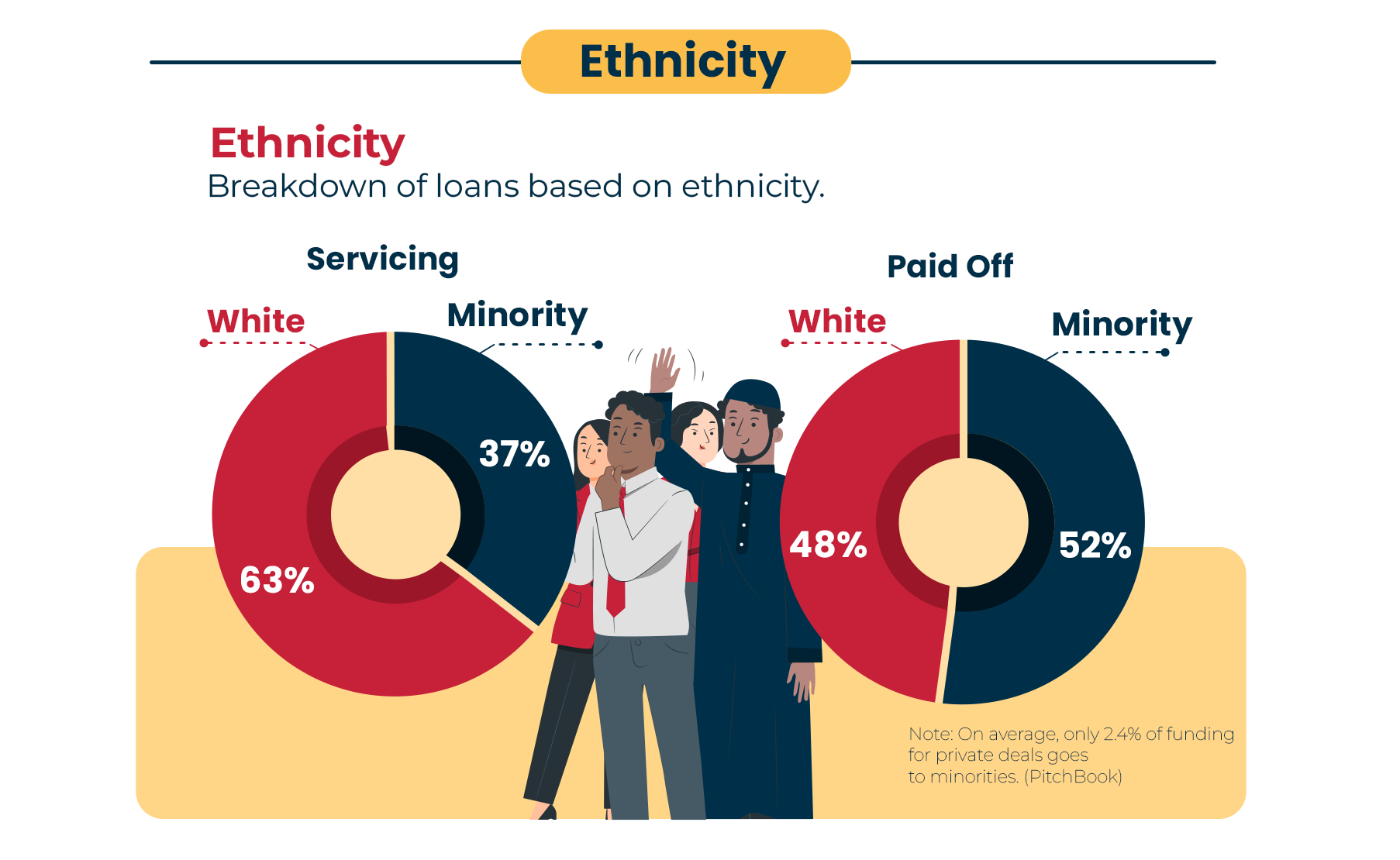

Ethnicity

Breakdown of Loans based on Ethnicity

Ready to do well and do good?

Get access to all the Kirkland Income Fund documents and find out if earning 10%+ passive income while doing good is right for you.