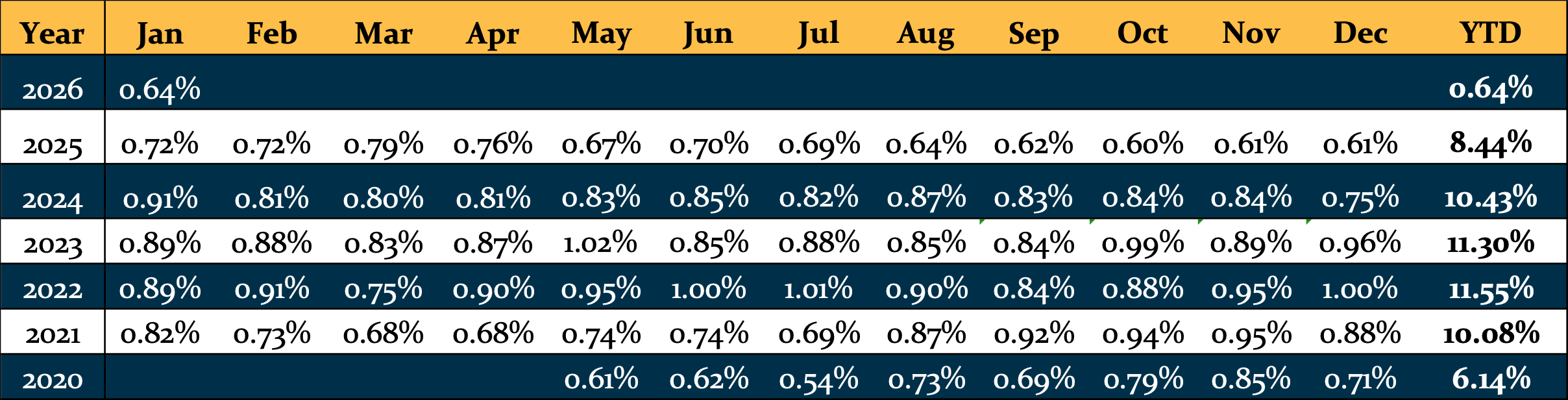

Kirkland Income Fund Performance Metrics

Consistent High-Yield Performance

Performance Snapshot

Trailing 12-Months

8.35%

Since Inception

75.32%

Dollar Weighted Return of the Portfolio

Past Performance is Not Indicative of Future Returns

As of January 2026

Consistent and Stable Returns

Related Resource: “The Importance of Consistent and Stable Returns in Fixed Income Investments”

Latest 24 Month Return

Monthly Return Since Inception

0%

Largest 1 Month Loss

0%

Max Peak to Valley Drawdown

(Monthly return swing from the highest to lowest)

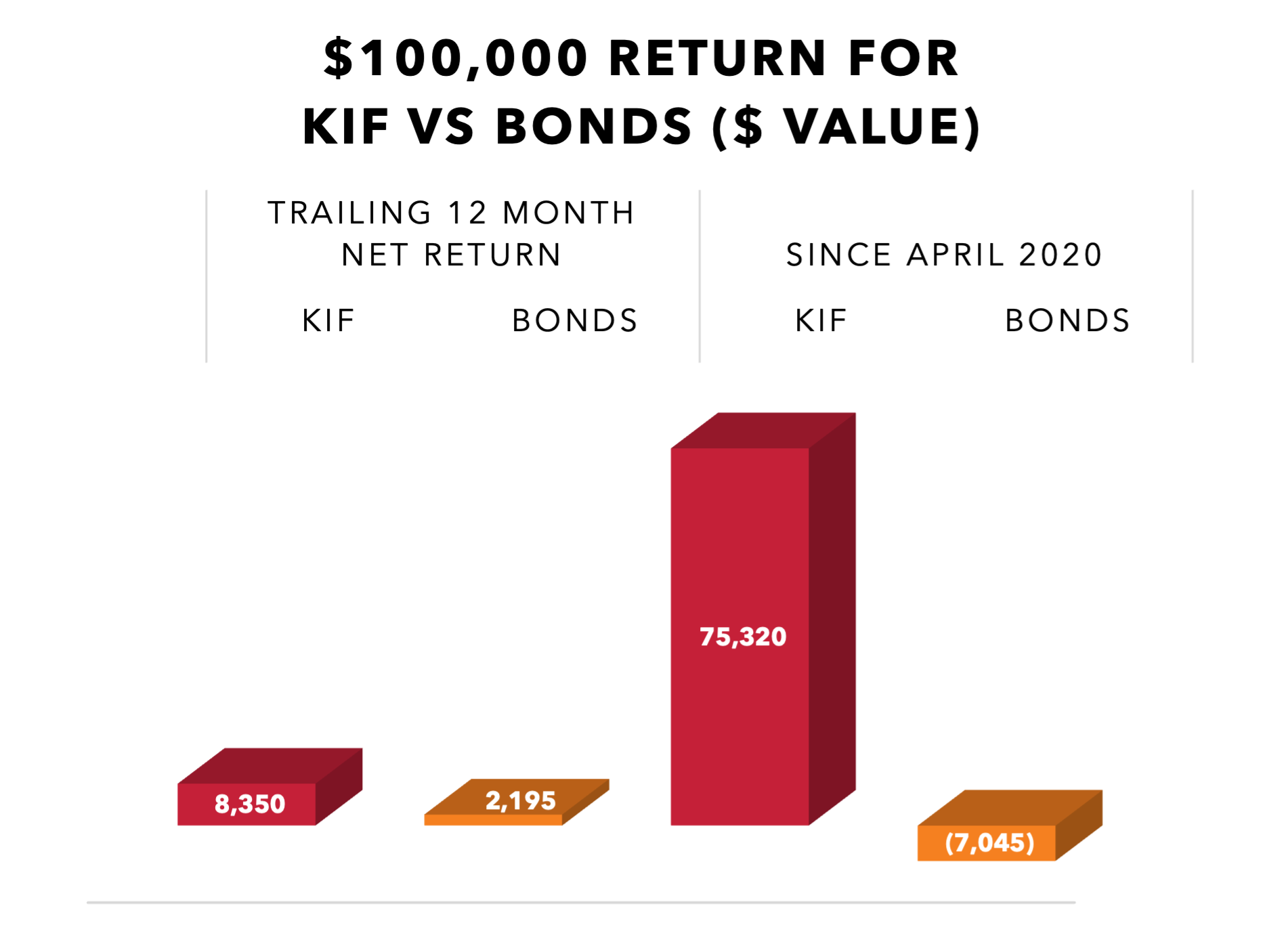

Comparison to Traditional Asset Classes

Return Versus Public Indices

Return Versus Bonds

Footnote: Until April 2023, we used the Bloomberg U.S. Aggregate Bond Index and then switched to the SPDR® Bloomberg U.S. Aggregate Bond ETF.

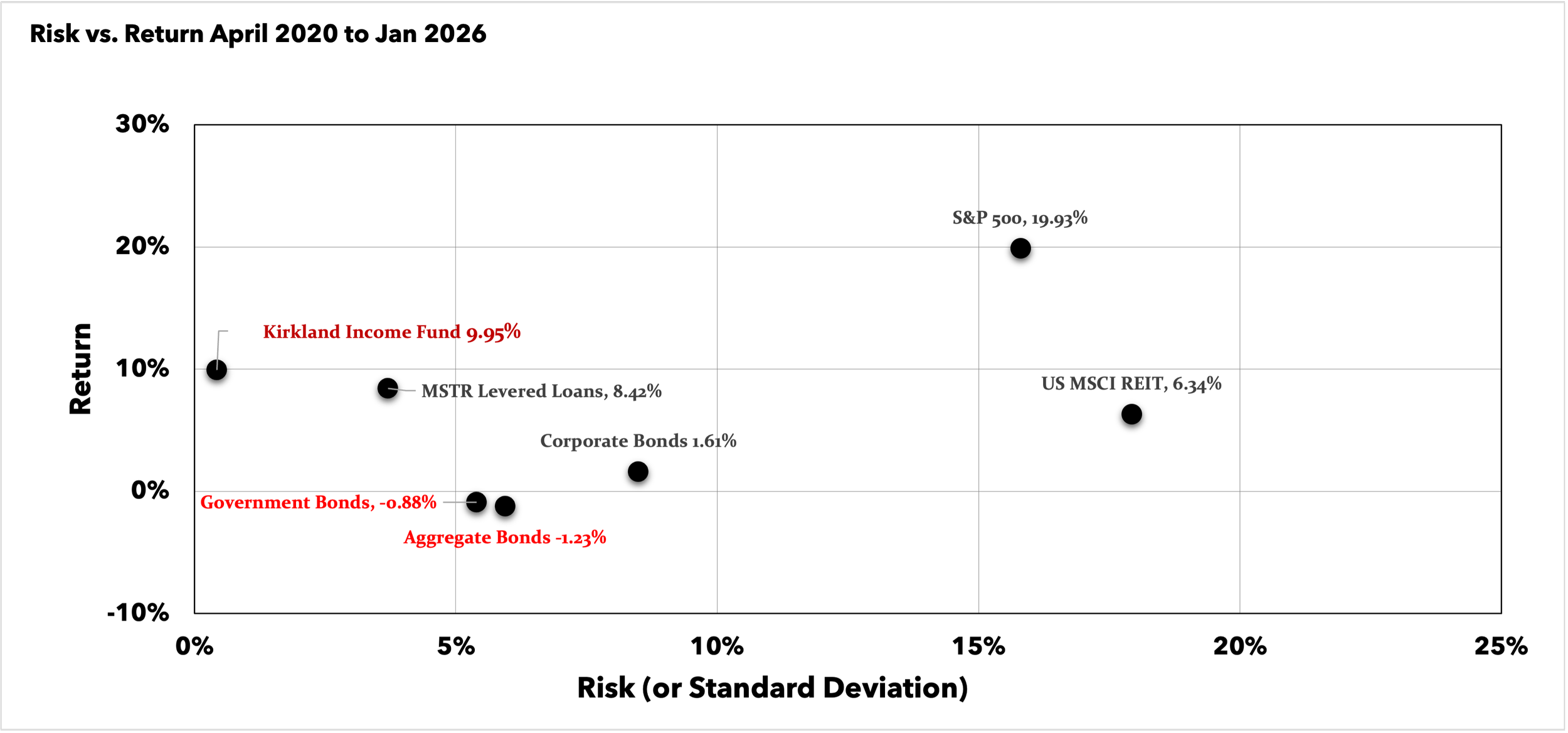

Equity Like Returns with Debt Level Risk

Related Resource: “Equity Like Returns with Debt Level Risk: Dream or Reality”

Standard deviation is a statistical measurement of how far a variable, such as an investment's return, moves above or below its average (mean) return. An investment with high volatility is considered riskier than an investment with low volatility; the higher the standard deviation, the higher the risk. The lower the standard deviation (closer to 0), the lower the risk.

Correlation

April 2020 to January 2026

It is the statistical measure that indicates the strength of a linear relationship between two or more variables. Understanding the relationships or correlations between the investments in your portfolio is foundational in determining if you are diversified enough.

-1 = Inverse Correlation, 0 = No Correlation, 1 = Positive Correlation

KIF Correlation to Indices

-0.20

S&P 500 TR Index

-0.04

SPDR Bloomberg Aggregate Bond ETF

-0.11

MSCI US REIT Index

-0.22

MSTR Levered Loans

Indices Correlations

S&P 500 TR Index to:

0.60

SPDR Bloomberg Aggregate Bond ETF

0.83

MSCI US REIT Index

0.60

MSTR Levered Loans

SPDR Bloomberg Aggregate Bond ETF to:

0.34

MSTR Levered Loans

0.61

MSCI US REIT Index

MSCI US REIT Index to:

0.51

MSTR Levered Loans

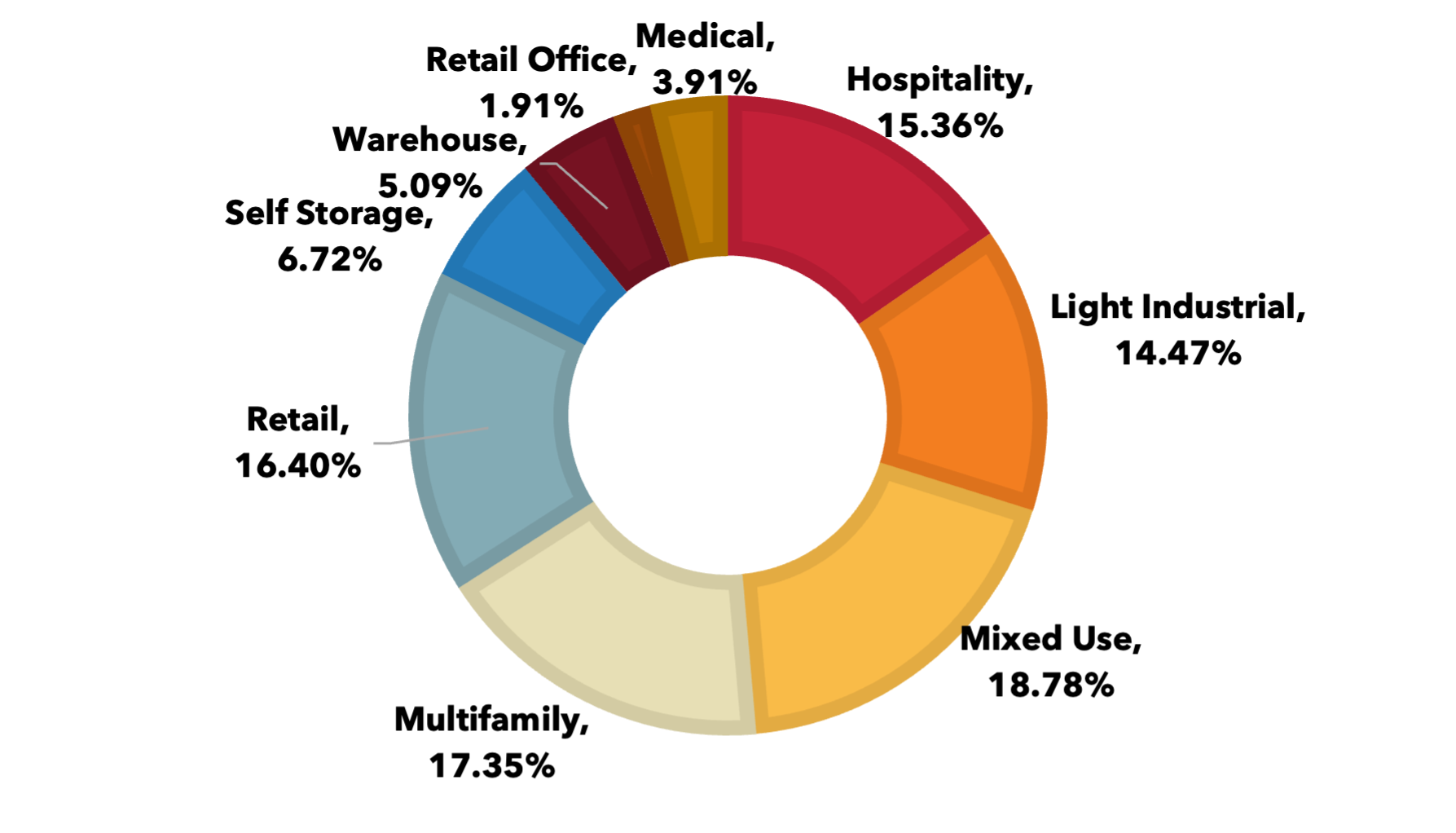

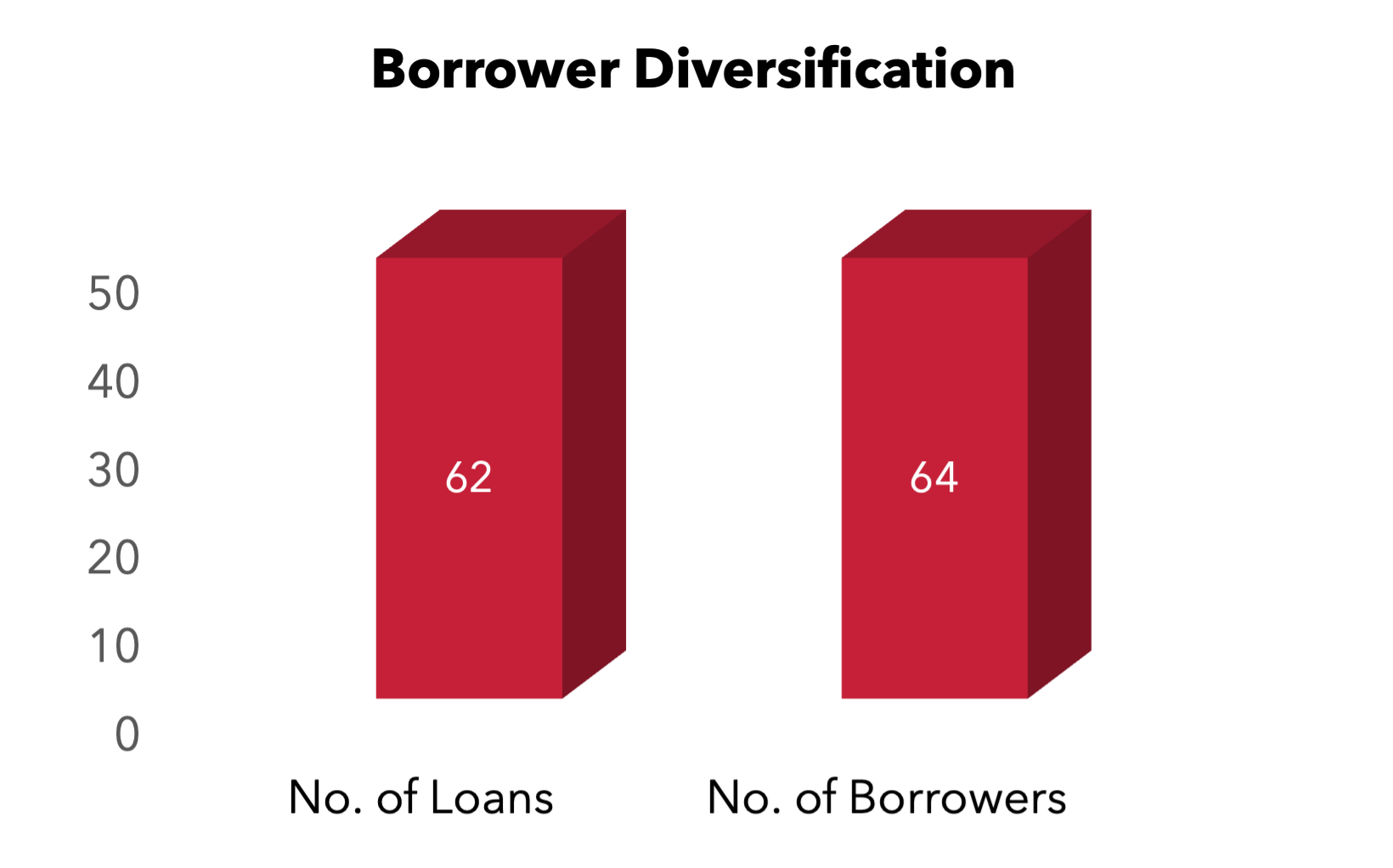

Diversified and Conservative Portfolio

Property Loan Type

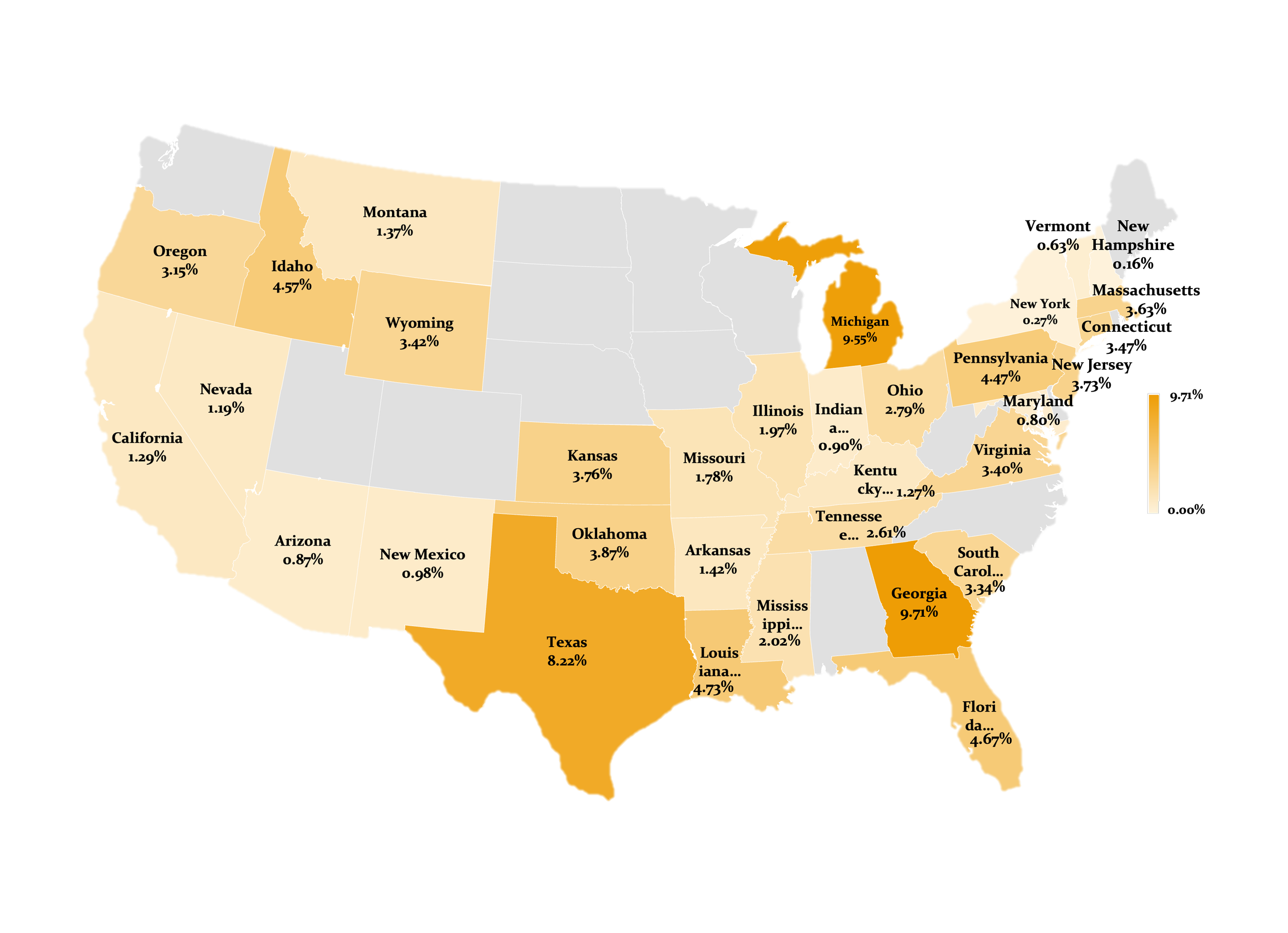

Geographical Loan Distribution

Portfolio Metrics

58.40%

Weighted Average Loan-To-Value (LTV)

8.15 Months

Weighted Average Maturity

Watch the Latest Quarterly Insights from Our Managing Partners

The videos are up to 1 hour long. We don't mind if you watch them at 2x speed. 😉

Kirkland Income Fund Investment Calculator

This calculator can be used to compute the potential future value of your private credit investment in the Kirkland Income Fund. Input the required information into the fields in the calculator, and press "Calculate" once you are done.

Be the Bank: Is Private Credit the Right Move for Your Portfolio?

Access the Investor Library with all the Kirkland Income Fund documents and discover how you can be the bank and earn 10%+ returns while lowering your investment portfolio risk.