The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

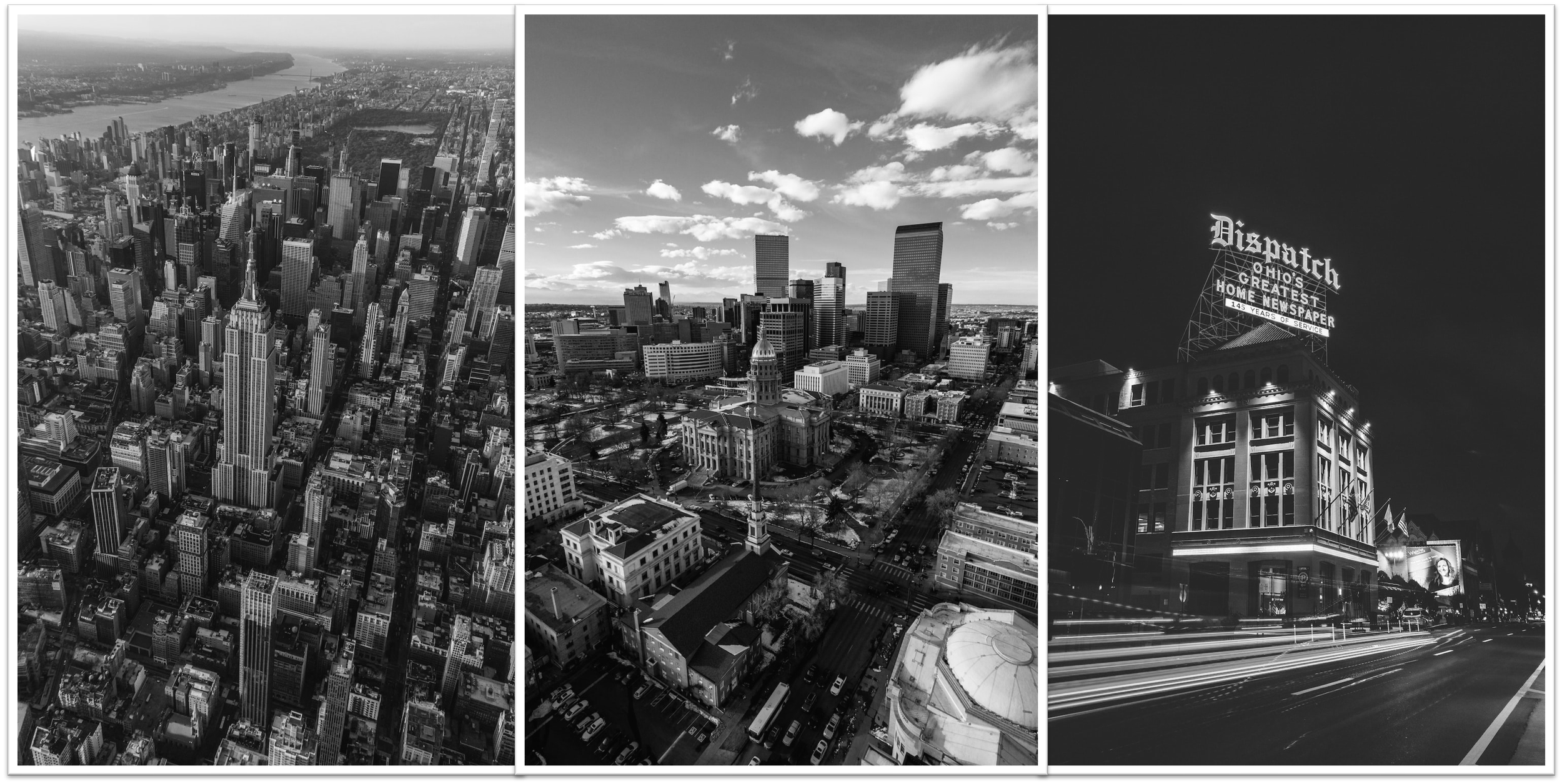

Real Estate Markets Series: What are Primary, Secondary, and Tertiary Markets

Real estate markets are categorized by the size of the population within a geographic area, as well as the availability of housing, economic activity, and job opportunities. In this series, we will explore what is considered primary, secondary, and tertiary real estate markets, as well as some of the risks and opportunities of each. We will even touch on rural markets.

Scott Jensen: Financial Planner for Real Estate Investors

In this interview we talk with Scott Jensen, CFP, the founder of Renovate Financial Planning. What makes Scott and Renovate unique is they specialize in working with Real Estate Investors.

He wakes up every day excited to get to work because he combines the career he loves, financial planning, with his side-gig of real estate investing. It’s difficult, as a Real Estate Investor, to find an advisor who understands real estate or who won’t advise you against it because they lack understanding of this important Alternative asset class. As a Real Estate Investor himself, and an avid researcher on all things real estate and financial planning, he is uniquely able help Real Estate Investors reach their financial and real estate goals.

Tap into Retirement Plan Dollars for Alternative Asset Investing

Hosted by CAIA Seattle, John Paul Ruiz of The Entrust Group shows how you can unlock the power of retirement plan capital for investing in alternative investments. There are 33 trillion dollars in retirement plans. Whether you are an advisor helping clients or an individual investor learn about the platforms available, rules and regulations, and how to get started in a broader utilization of your retirement plan assets.

The Solo 401k Plan – The Power to Invest in Commercial Real Estate Equity and Debt

The Solo 401k Retirement Plan offers powerful advantages for real estate investors. A Solo 401k Plan (also known as Individual 401k) is an IRS-approved Qualified Retirement Plan that has been simplified for the self-employed and those who own a small business. The structure of the plan gives participants more options than a conventional 401k. The Solo 401k’s unlimited investment capability, loan feature, and tax benefits make it the perfect vehicle for investing in real estate.

When Your 1031 Exchange is in Trouble

When Your 1031 Exchange is in Trouble, don't buy a property you would not buy if you were not under time pressure. There are other Capital Gains Tax Deferral options available to you.