The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

Infinity Investment Strategies Member of the Month Featuring Kirkland Capital Group

At Kirkland Capital Group, we are proud to share that our very own Chris Carsley was recently featured on the Infinity Investment Strategies podcast, hosted by Erica Neal. With a distinguished career in hedge funds, portfolio management, and alternative investments, Chris shared his unique insights and expertise on various topics, including the evolving landscape of private debt and fixed income investments.

He also talks in depth about our fund, the Kirkland Income Fund. This is a great video to watch for current and potential investors in the fund as Erica asks insightful questions that maybe on the mind of many investors.

From Pre-Med to Private Debt: An Investor Interview with Nabil Istafanous

Do you want to hear from a successful investor who has a diversified portfolio of non-correlated assets? Do you want to get some valuable advice from a seasoned entrepreneur who has a unique and unconventional career path? Do you want to learn more about alternative lending and private debt? If you answered yes to any of these questions, then you will love our latest investor interview with Nabil Istafanous.

Equity-like Returns with Debt-Level Risk: Dream or Reality?

Equities, or stocks, have always held a strong appeal for investors and have been a fundamental component of numerous investment portfolios for valid reasons. Historically, the S&P 500 (including dividends) have yielded an impressive average return of 12.8% from 1950 to 2023. Nevertheless, this trajectory has been anything but steady, characterized by significant events such as Black Monday (which saw the Dow plummet by -22%), the Internet Bubble Crash (resulting in a -78% loss for NASDAQ), and the Great Financial Crisis (where the S&P 500 experienced a decline exceeding -20%).

For those who prefer a more conservative investment strategy, bonds present an opportunity for stability, capital preservation, and offering a consistent flow of interest payments. From 1950-2023, the 10-year treasury bond has maintained an average yield of 5.4%, providing a “calmer” investment option compared to stocks, albeit with returns around 40% lower and without the highs and lows associated with the stock market. However this doesn’t mean there hasn’t been any fluctuations in its returns.

Rise of Private Private Credit

Traditional fixed income has faced challenges over the past few years, while equities or stocks have thrived in contrast. This shift has paved the way for the rise in popularity of alternative investments such as private credit, as investors seek to strengthen the fixed income segment of their portfolios.

Deep Dive Into Asset-Backed Funds

What are asset-backed funds? Our Chief Investment Officer, Chris Carsley, was part of a panel that did a deep dive into asset-backed funds. He was with Michael Flight, co-founder of Liberty Real Estate Fund, and hosted by Patrick Grimes of Passive Investment Mastery. They discussed the ins and outs of investing in asset-backed funds. They also discussed funds dealing with private debt, private equity, and even funds in the exciting world of blockchain in real estate.

The Importance of Consistent and Stable Returns in Fixed Income Investments

In the vast landscape of investment options, income funds have carved out a significant niche for themselves. Designed to provide a steady income stream to investors, these funds are often comprised of a variety of income-generating assets such as bonds, dividend-paying stocks, and real estate related investments. They play a crucial role in a well-diversified portfolio, particularly for those investors seeking regular income, or those looking for a more conservative investment strategy.

Why Traditional Investment Diversification May No Longer Be Enough

Private debt has historically been a source of yield that has low correlation to traditional asset classes. Due to the current condition of the market, more investors are asking us about building a resilient personal investment portfolio, and how diversification and correlation figure into that resilience. Let’s see what we can learn from how Institutional Investors are doing in today's market conditions.

The following paragraphs summarize key points related to diversification published on the CAIA Association website in an article on Institutional Investors' Portfolio Design[1].

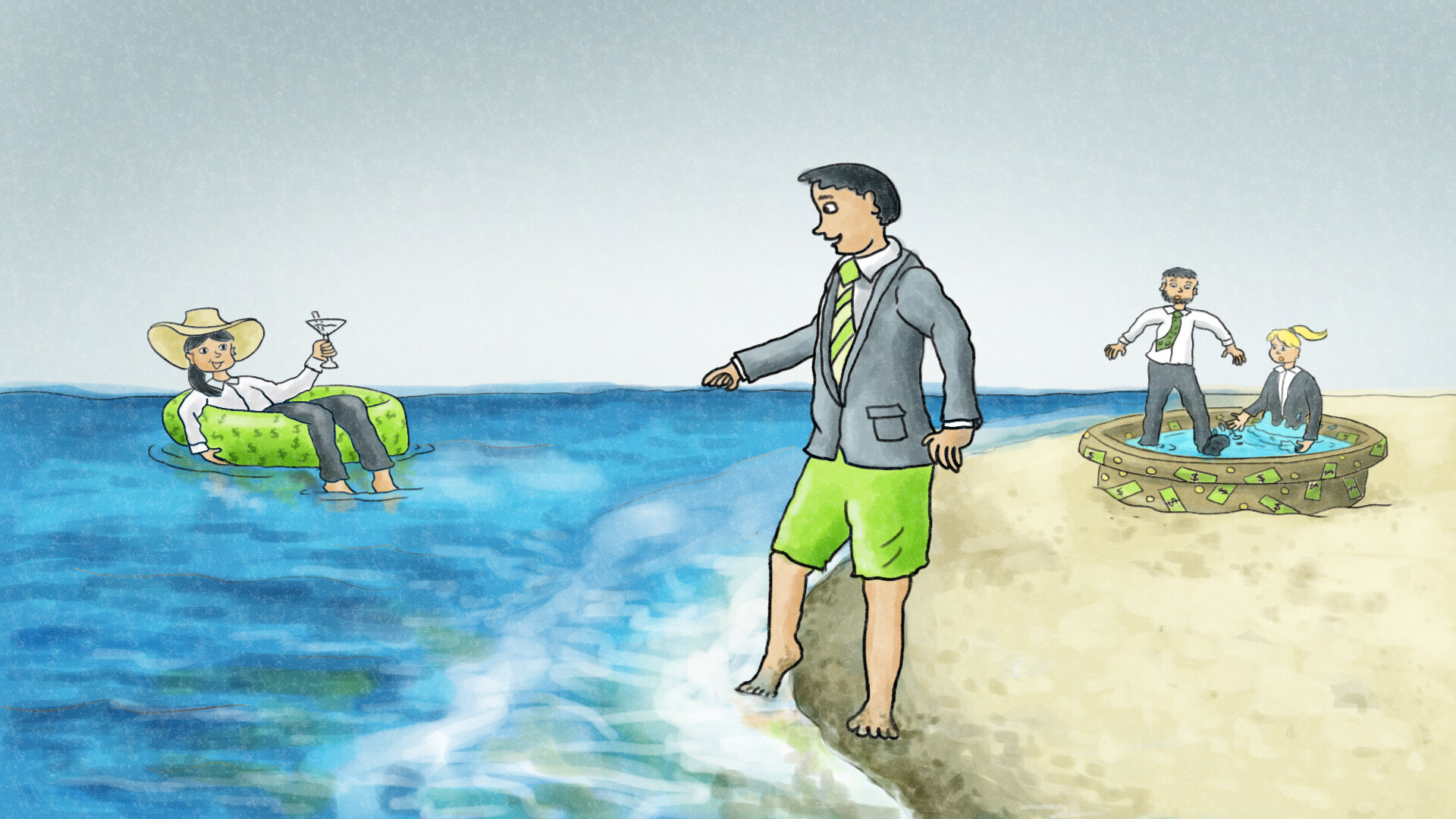

3 Ways the Rich Get Richer with Private Alternative Investments, and How You Can Too

As a newly qualified accredited investor, you may be asking yourself “what is the next step for my investment portfolio?”

Let’s look at two university classmates, Annie and Tom, who have had similar successful tech industry roles, similar household income, and comparable living costs. It’s now the future and both are turning 50 this year. Annie is, along with her spouse, retiring this year as they have enough income from investments to replace the income from their jobs; they are financially independent. Tom and his spouse, on the other hand, are making standard progress in their retirement investments, but are years away from having enough investment income to retire.

Are Real Estate Debt Funds a Replacement for Bonds?

In this live online interview Chris Carsley and Brock Freeman talk with Brandon Walsh at Rocket Dollar about alternative investments, the death of the sixty forty or at least the lower interest rate bond market's impact on the low-risk part of your investment portfolio, what to look for risk-wise when exploring private investment funds, what we have done to lower operational risk and be transparent with our Kirkland Income Fund, and much more.