3 Ways the Rich Get Richer with Private Alternative Investments, and How You Can Too

Why You Should Make Your First Private Alternative Investment

As a newly qualified accredited investor, you may be asking yourself “what is the next step for my investment portfolio?”

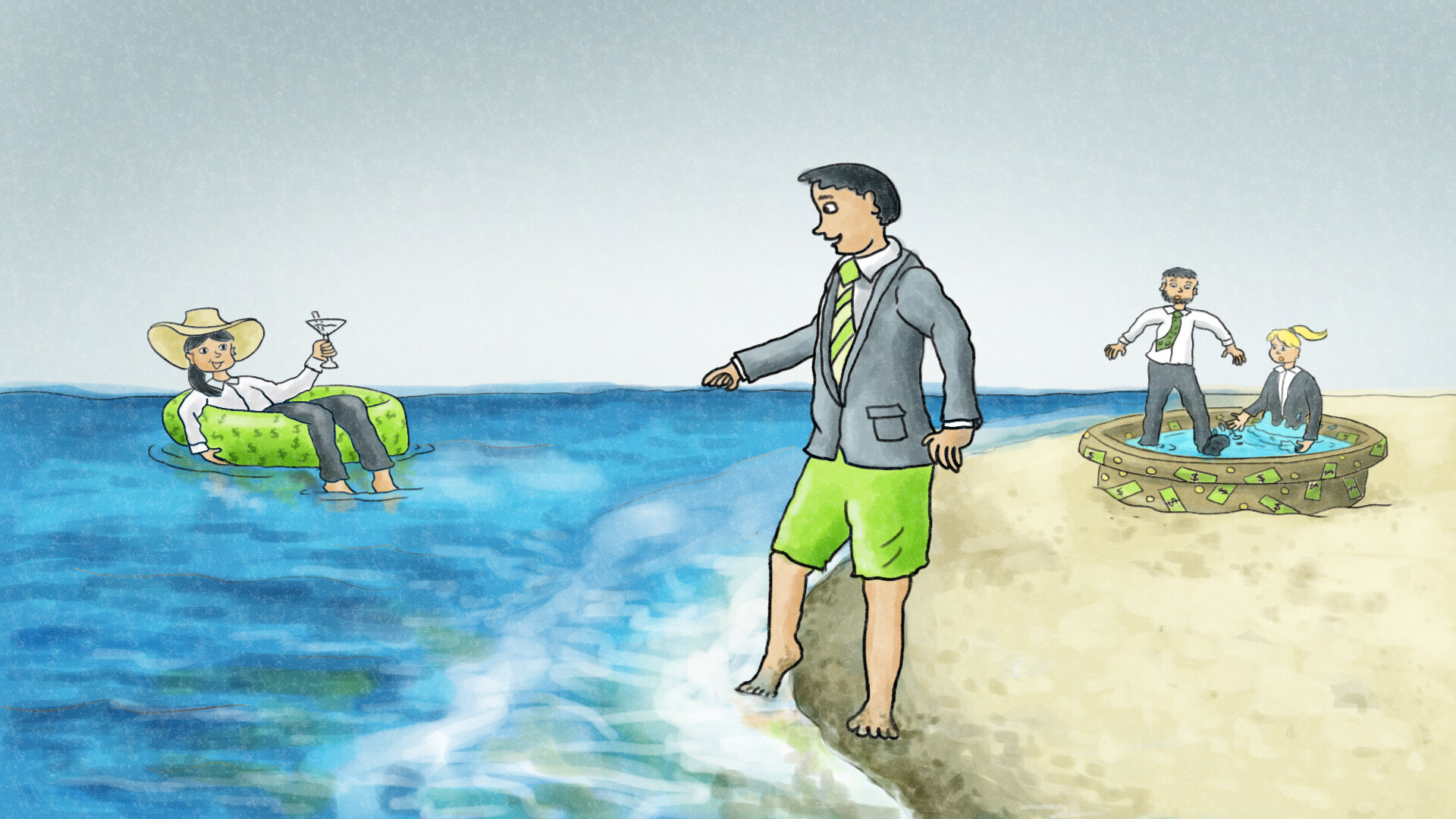

Let’s look at two university classmates, Annie and Tom, who have had similar successful tech industry roles, similar household income, and comparable living costs. It’s now the future and both are turning 50 this year. Annie is, along with her spouse, retiring this year as they have enough income from investments to replace the income from their jobs; they are financially independent. Tom and his spouse, on the other hand, are making standard progress in their retirement investments, but are years away from having enough investment income to retire.

Even if you love what you do so much you have no plan to retire early, having financial independence would give you the option and the ability to make career choices on your terms. So, what happened to give Annie such a big advantage in her investing?

There is great potential in generating wealth through investments outside of the stock and bond market. Annie and Tom were fully invested with their company 401k plans and their non-retirement accounts. However, years before turning 50, when Annie had qualified as an accredited investor with a pay raise, Annie discovered private alternative investments. Private alternative investments provide greater flexibility with choices that can generate higher relative returns, and deliver important portfolio diversification that builds and fortifies your wealth over time.

So, what are alternative investments and why did “Alts Annie” do better with her investments versus “Traditional Tom”?

What is an Alternative Investment?

Chris Carsley, Managing Partner and Chief Investment Officer at Kirkland Capital Group, states: “When you’re looking at alternatives [investments], you’re looking at everything that’s not long stocks and long bonds”.

Hedge funds, venture capital, private equity, real estate, cryptocurrency, precious metals, and more, are all part of this alternative class of investments.

Within the class of alternative investments, there are two broad categories: public or private investments. Public alternative investments are those commonly available via standard trading and investment platforms which everyone has access to, such as TD Ameritrade, Schwab, Fidelity, Robinhood, or even via your 401(k) account. A common public alternative investment is a Real Estate Investment Trust (REIT), which you may even currently hold as a good diversification investment in your portfolio. However, public alternative investments miss a lot of the advantages of private alternative investments. For example, contemporary research shows that private real estate funds significantly outperform REITs, typifying the broader theme in recent years of dwindling public market returns against a growing private market. For those who qualify, choosing private alternative investments over similar public alternative investments is what constitutes the greatest differentiations in portfolio returns.

Why Invest in Private Alternative Investments?

“When it is obvious that the goals cannot be reached, don’t adjust the goals, adjust the action steps.”

Institutional investors have been reaping the benefits of investing in the private alternative asset class for decades. However, a common misconception about ‘alternative investments’ is that only large institutional investors have access to or adequate knowledge about making these types of investments. Smart individual investors like Alts Annie have also discovered and taken advantage of these opportunities, and so can you. Below are three reasons why you should start to invest in private alternative investments today:

1. Diversification

Do you want more risk or less risk in your portfolio?

As you have experienced, the stock market is unpredictable in nature. Even in a stable economy, unpredictable fluctuations can occur in your portfolio. Some private alternative investments are countercyclical or non-correlated to the public market. When the public market falls, they remain steady in their value or even appreciate and offset other portfolio losses. These private alternative investments can, as Chris Carsley states, “de-risk your portfolio and capture an excess return on comparison to other peer or similar investments”.

Some investors assume they can achieve a diversified portfolio by holding REITs or other publicly traded alternatives. However, these public alternatives are still often correlated to the stock market and consequently add little de-risking value. There are private alternative investments that can be detached from public market shifts and therefore can significantly benefit the overall risk-adjusted performance of your portfolio.

2. Lower Volatility

Would you like a return of $1,300,000+ or $207,000?

Traditional public market share prices fluctuate based on a variety of factors, including algorithm-driven institutional trading, concentration of holdings across many different funds, and rapid swings caused by emotional behavior.

There is an argument that if you are a long-term investor, then short-term volatility is insignificant against longer timescale returns. However, this argument fails to recognize how volatility impacts compounding. For example, the two scenarios outlined below detail an initial investment of $100,000 growing over 30 years. The first graph exemplifies investing $100,000 in the stock market where there are dramatic annual gains and losses and results in a 10% average annual return. The second graph shows a respectable and consistent (low volatility) 9% return every single year.

| Year | Return | Value | Year | Return | Value | Year | Return | Value |

|---|---|---|---|---|---|---|---|---|

| 1 | 50% | 150,000 | 11 | 50% | 191,442 | 21 | 50% | 244,334 |

| 2 | -30% | 105,000 | 12 | -30% | 134,010 | 22 | -30% | 171,034 |

| 3 | 50% | 157,500 | 13 | 50% | 201,014 | 23 | 50% | 256,551 |

| 4 | -30% | 110,250 | 14 | -30% | 140,710 | 24 | -30% | 179,586 |

| 5 | 50% | 165,375 | 15 | 50% | 211,065 | 25 | 50% | 269,378 |

| 6 | -30% | 115,763 | 16 | -30% | 147,746 | 26 | -30% | 188,565 |

| 7 | 50% | 173,644 | 17 | 50% | 221,618 | 27 | 50% | 282,847 |

| 8 | -30% | 121,551 | 18 | -30% | 155,133 | 28 | -30% | 197,993 |

| 9 | 50% | 182,326 | 19 | 50% | 232,699 | 29 | 50% | 296,990 |

| 10 | -30% | 127,628 | 20 | -30% | 162,889 | 30 | -30% | 207,893 |

Average Return 10% $207,893

| Year | Return | Value | Year | Return | Value | Year | Return | Value |

|---|---|---|---|---|---|---|---|---|

| 1 | 9% | 109,000 | 11 | 9% | 258,043 | 21 | 9% | 610,881 |

| 2 | 9% | 118,810 | 12 | 9% | 281,266 | 22 | 9% | 665,860 |

| 3 | 9% | 129,503 | 13 | 9% | 306,580 | 23 | 9% | 725,787 |

| 4 | 9% | 141,158 | 14 | 9% | 334,173 | 24 | 9% | 791,108 |

| 5 | 9% | 153,862 | 15 | 9% | 364,248 | 25 | 9% | 862,308 |

| 6 | 9% | 167,710 | 16 | 9% | 397,031 | 26 | 9% | 939,916 |

| 7 | 9% | 182,804 | 17 | 9% | 432,763 | 27 | 9% | 1,024,508 |

| 8 | 9% | 199,256 | 18 | 9% | 471,712 | 28 | 9% | 1,116,714 |

| 9 | 9% | 217,189 | 19 | 9% | 514,166 | 29 | 9% | 1,217,218 |

| 10 | 9% | 236,736 | 20 | 9% | 560,441 | 30 | 9% | 1,326,768 |

Average Return 9% $1,326,768

Even though the average annual return was lower in the second scenario, because of lower downside volatility exposure the compound effect resulted in an end value 638% higher than in the first scenario. Lower volatility matters to your returns. Private alternative investments are not publicly traded and some, such as real estate debt or equity funds, are backed by real assets which can help dampen volatility.

3. Enhanced Return & Strong Income

Do you want strong steady income or erratic gains?

It has become increasingly difficult to generate good income from public market investments. A significant sum of money must be invested in the stock market to generate a larger dollar target cash flow, such as what you may need in retirement. Consequently, this investment would expose the investor to a high level of risk. Perhaps more risk than you are willing to take.

In stark contrast, many private funds are structured in a way that allow investors to get paid first, in cash, when profits are made. Not all private alternative investments are cash-flow focused—i.e., you are paid in cash on a monthly or quarterly basis—but there are plenty that are. Some can produce strong income dividends of 7-10%+ annually. Before retirement this income can be used to compound your returns or further diversify; in retirement they provide the important steady income you need.

Financial Security

The world of private alternative investments is open to you and can complement your existing investment portfolio. Every accredited investor should at least consider private alternative investments for their diversification, flexibility, and strong returns. Start following the Steps to Your First Private Alternative below. It is the reason “Alts Annie” did far better with her investments versus “Traditional Tom”. Be like Alts Annie.