The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 4

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 11

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 9

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

Rise of Private Private Credit

Traditional fixed income has faced challenges over the past few years, while equities or stocks have thrived in contrast. This shift has paved the way for the rise in popularity of alternative investments such as private credit, as investors seek to strengthen the fixed income segment of their portfolios.

Deep Dive Into Asset-Backed Funds

What are asset-backed funds? Our Chief Investment Officer, Chris Carsley, was part of a panel that did a deep dive into asset-backed funds. He was with Michael Flight, co-founder of Liberty Real Estate Fund, and hosted by Patrick Grimes of Passive Investment Mastery. They discussed the ins and outs of investing in asset-backed funds. They also discussed funds dealing with private debt, private equity, and even funds in the exciting world of blockchain in real estate.

Real Estate Markets Series: What are Primary, Secondary, and Tertiary Markets

Real estate markets are categorized by the size of the population within a geographic area, as well as the availability of housing, economic activity, and job opportunities. In this series, we will explore what is considered primary, secondary, and tertiary real estate markets, as well as some of the risks and opportunities of each. We will even touch on rural markets.

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

Dr. Adam Gower’s DEAL TIME! Interview

Watch or listen as Dr. Adam Gower interviews Chris Carsley & Brock Freeman about Kirkland Capital Group's Bridge Finance Debt Fund investment opportunity.

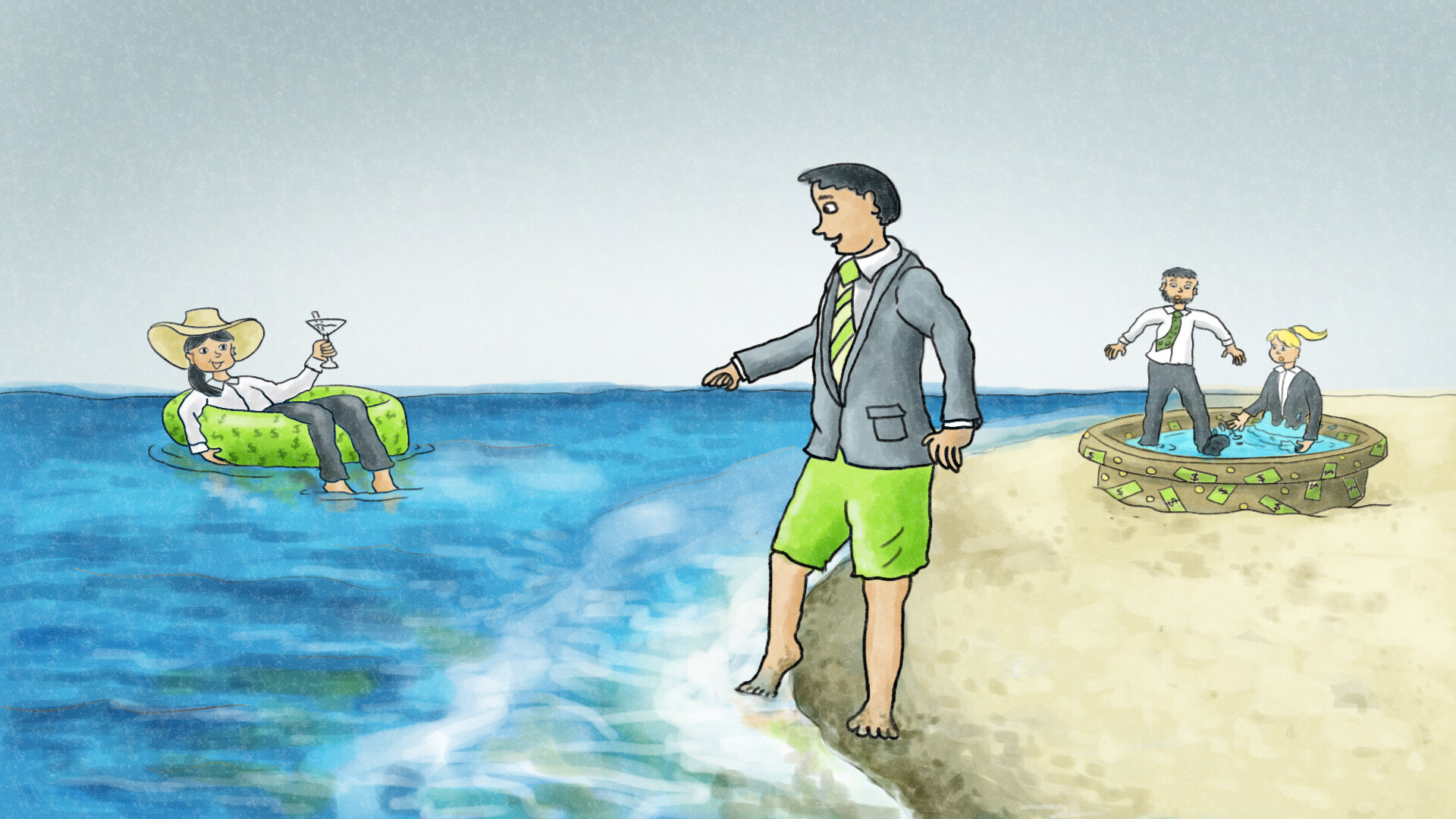

3 Ways the Rich Get Richer with Private Alternative Investments, and How You Can Too

As a newly qualified accredited investor, you may be asking yourself “what is the next step for my investment portfolio?”

Let’s look at two university classmates, Annie and Tom, who have had similar successful tech industry roles, similar household income, and comparable living costs. It’s now the future and both are turning 50 this year. Annie is, along with her spouse, retiring this year as they have enough income from investments to replace the income from their jobs; they are financially independent. Tom and his spouse, on the other hand, are making standard progress in their retirement investments, but are years away from having enough investment income to retire.

Understanding “Micro-Balance” Bridge Lending

Most lenders do not consider commercial real estate bridge loans under $1M. That’s where Kirkland Capital Group enters the picture. They’ve leveraged this opportunity by building the Kirkland Income Fund, delivering a “micro-balance" commercial mortgage option. Chris Carsley and Brock Freeman of Kirkland join Lance to talk about the ins and outs: how the Fund offers investors lower risk and consistent annual fixed income returns, how they approach the underwriting process, commercial mortgage brokers, and assessing borrower risk.

Tap into Retirement Plan Dollars for Alternative Asset Investing

Hosted by CAIA Seattle, John Paul Ruiz of The Entrust Group shows how you can unlock the power of retirement plan capital for investing in alternative investments. There are 33 trillion dollars in retirement plans. Whether you are an advisor helping clients or an individual investor learn about the platforms available, rules and regulations, and how to get started in a broader utilization of your retirement plan assets.

8 Factors to Determine If an Investment Fund Manager Is Putting Investors First

Lots of managers say, "Investor First," but it is only when you dig into the fund documentation and really spend time understanding the management team, fees, and fund details can you better assess if this is the case. Regardless of the investment platform, here are eight factors for investors to consider when reviewing fund managers to see if they are putting investors first.

Are Real Estate Debt Funds a Replacement for Bonds?

In this live online interview Chris Carsley and Brock Freeman talk with Brandon Walsh at Rocket Dollar about alternative investments, the death of the sixty forty or at least the lower interest rate bond market's impact on the low-risk part of your investment portfolio, what to look for risk-wise when exploring private investment funds, what we have done to lower operational risk and be transparent with our Kirkland Income Fund, and much more.

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

Not yet ready to go direct with Kirkland Capital Group? You can still invest 👌

Does this sound like you: I’d like to take advantage of the higher returns and lower risk of passive real estate investment; however, I’m not ready to commit the required amount of money for a year to a private real estate investment fund.

The good news, you have a choice.

Diversifying Risk & Capturing Higher Returns with Alternative Investments

Alternative Investment Expert Chris Carsley talks about how to get started personally investing in Alternatives.

Park Place Investment Interviews Kirkland Capital Group's Chris Carsley & Brock Freeman

Watch Brock Freeman and Chris Carsley of Kirkland Capital Group discuss the their approach to investment in the Kirkland Income Fund with Park Place Investment.

Kirkland Income Fund Listed on Park Place Investment

Park Place Investment has teamed up with Kirkland Capital Group to make the Kirkland Income Fund available on their online crowdfunding platform specializing in commercial real estate.

The Solo 401k Plan – The Power to Invest in Commercial Real Estate Equity and Debt

The Solo 401k Retirement Plan offers powerful advantages for real estate investors. A Solo 401k Plan (also known as Individual 401k) is an IRS-approved Qualified Retirement Plan that has been simplified for the self-employed and those who own a small business. The structure of the plan gives participants more options than a conventional 401k. The Solo 401k’s unlimited investment capability, loan feature, and tax benefits make it the perfect vehicle for investing in real estate.