The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

Regulation Best Interest (Reg BI): What Accredited Investors Need to Know

Regulation Best Interest (Reg BI) protects accredited investors by raising the bar for disclosures, due diligence, and conflicts management. This guide breaks down what to expect from brokers—and how to evaluate private placements with clarity and confidence.

Third-Party Fund Oversight: Why Investors Need Administrators and Auditors

Independent oversight is one of the strongest safeguards investors have. Learn how third‑party fund administrators and auditors protect your capital through transparent reporting, accurate valuations, and unbiased verification.

State of Micro-Balance Commercial Real Estate (CRE) Private Debt: 2025 Recap and 2026 Outlook for Investors

A niche often ignored by banks is generating 8–10%+ secured yields for accredited investors. This report breaks down 2025 results, the 2026 outlook, and the strongest opportunities in micro‑balance CRE private debt—from rate cuts and refinancing tailwinds to sector‑by‑sector performance.

What Is a Fund of Funds? Structure, Advantages, and Fee Risks

A Fund of Funds (FoF) offers investors a single entry point to a diversified portfolio of professionally managed funds—spanning private equity, hedge funds, and more. While FoFs provide access to exclusive strategies and simplify portfolio management, they come with trade-offs like layered fees and reduced transparency. Our latest paper explores the structure, benefits, and risks of FoFs, helping you decide if this approach aligns with your investment goals.

Accredited Investor Rules in 2026: What They Are, Requirements, and How to Qualify

An accredited investor is someone who meets specific financial or professional criteria, allowing them to invest in private securities offerings not registered with the SEC. In 2025, the rules have evolved: eligibility now includes not just income or net worth thresholds, but also professional certifications and certain roles within investment firms. The SEC’s latest updates emphasize financial acumen alongside financial capacity, expanding access to private markets while maintaining rigorous standards. If you’re considering becoming an accredited investor, ensure you meet the criteria, prepare your documentation, and understand the risks—private investments are high-risk and illiquid, demanding thorough due diligence.

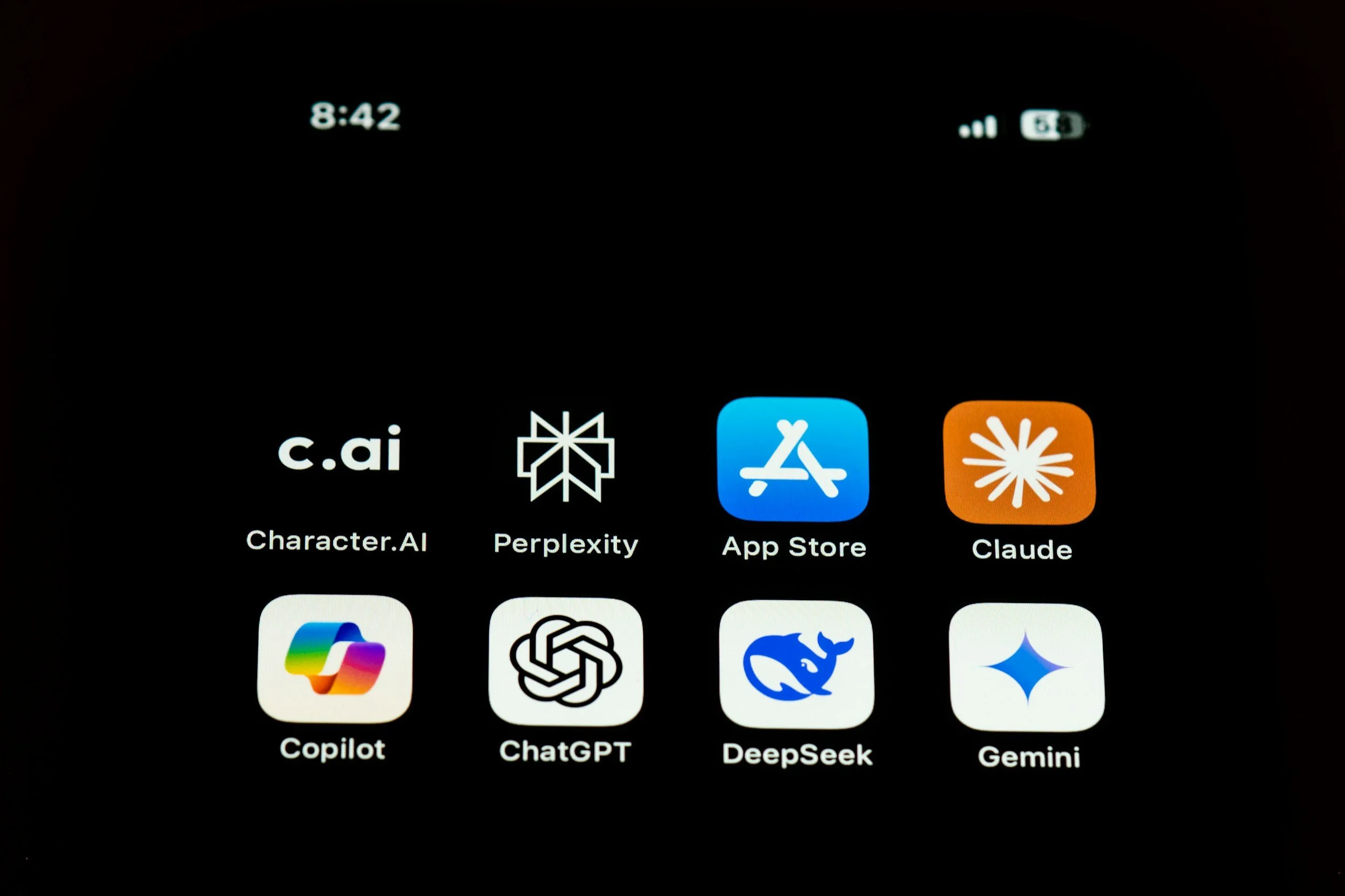

How We Built an AI Prompt to Help Investors Perform Due Diligence on Private Funds

When Microsoft Copilot became available last year, we saw an opportunity—not just to experiment with AI, but to integrate it meaningfully into our workflows. Since then, we’ve embedded AI into our processes across the company, from underwriting and loan servicing to investor communications and compliance reviews.

But one area where we felt AI could be a valuable tool is in due diligence.

There’s been a lot of discussion in one of the investor forums we’re part of about using AI to perform due diligence on private investment funds. We’ve read the commentary, and we agree: AI has the potential to help investors ask sharper questions and make more informed decisions.

So we decided to take it a step further.

YieldStreet’s Real Estate Collapse: Fintechs in Alternative Investments

What is it with Fintech platforms with the word Street in their name? First was PeerStreet, and now YieldStreet. CrowdStreet is another one facing challenges.

These failures are a bit different from each other but at the heart of the issue is poor operational management, and lack of proper risk management. In YieldStreet’s case there are also multiple cases of misrepresentation.

Proven Strategies to Avoid Costly Mistakes in Alternative Investments

Navigating the complex world of alternative investments requires precision and due diligence. In this article, we summarize key insights from a recent IRA Club webinar featuring Chief Investment Officer Chris Carsley. Chris emphasizes the importance of education and continuous learning as essential tools for high-net-worth investors. From setting investment priorities to leveraging networks for insight, this article covers essential strategies to avoid costly mistakes. Dive in to learn how to perform due diligence effectively and elevate your investment strategies with confidence.

One Big Beautiful Bill Overview and Commentary

Discover the transformative impact of the One Big Beautiful Bill Act on real estate investment and tax incentives. Signed into law by President Donald Trump on July 4, 2025, this landmark legislation reshapes the U.S. tax code, offering substantial benefits for real estate investors. Learn about the key provisions, including 100% bonus depreciation, permanent 20% Qualified Business Income deduction, and Opportunity Zones, as well as the potential risks and long-term fiscal impacts.

CRE Investing in Changing Market Conditions, Panel Discussion

During Verivest’s Investment Summit last November ‘22, Chris Carsley - CFA, CAIA, Chief Investment Officer (CIO) & Managing Partner at Kirkland Capital Group was one of the panelist for their session on “CRE Investing in Changing Market Conditions”