The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

Schedule K-1 and Form 1099. What, Why, Who, and How?

Unlocking the Power of a Self-Directed 401(k)

As an investor, you’re likely always on the lookout for innovative ways to grow and protect your wealth. However, there’s one powerful tool that remains relatively underutilized—the self-directed 401(k). In a recent interview with Matthew Brauer from eQRP, we explored the many advantages of utilizing this retirement vehicle for those looking to take greater control of their retirement funds.

Understanding the Advantages of the Kirkland Income Fund Sub-REIT

At Kirkland Capital Group, our foundational ethos is centered around being investor focused. This principle guided us in constructing our fund to prioritize our investors' best interests, ensuring that our fees, expenses, compliance, and operations are all in alignment with their needs. Consequently, we have adopted a Sub-REIT structure as part of our strategy to maximize returns and provide tax benefits to our qualified investors.

Why Savvy Investors Should Consider Private Debt in Real Estate

In an investment landscape that often feels like a tug-of-war between risk and reward, private debt in real estate offers a unique opportunity for investors to achieve stability and high returns. For those looking to diversify beyond traditional equities and bonds, private debt in real estate provides an intriguing opportunity. This was the focus of Chris and Brock's discussion as they guested on the eQRP podcast, hosted by Matthew Brauer, a platform that offers a self-directed retirement plan allowing individuals to invest in a wide range of assets.

Unlocking Opportunities: The Kirkland Capital Group's Strategy for Niche Commercial Real Estate Loans

Join our founders, Chris Carlsey and Brock Freeman, as they discuss KCG's investment strategies, risk management techniques, and the importance of transparency with investors. This is perfect for anyone interested in real estate and private debt funds.

The Unbankable Deal: A Conversation with Malcolm Turner

I recently had the privilege of interviewing Malcolm Turner, the CEO and President of Castle Commercial Capital. He is a pillar in Detroit and has done numerous deals with us at Kirkland Capital Group. He is also an author of the book, Financing the Unbankable Deal: How to Buy Commercial Real Estate with the Bridge Loan Investor Success Strategy. In this fireside chat, we talk about his background, how he started his company, why a lot of investors are looking at Detroit, what are the trends he is seeing in real estate, his strategies when looking at real estate, and a lot more. You wouldn’t want to miss this video!

Altigo Beyond Real Estate - Private Credit

When discussing real estate, most people first think of equity real estate transactions in single family, multi-family or public REITs. However, a significant part of this transaction actually involves credit, either a bank or a non-bank lender. In a webinar called "Beyond Real Estate" by Altigo, they invited Chris Carsley, our Chief Investment Officer, to join a panel discussion about alternatives to equity in real estate.

Private Credit: Unlocking Profitable Investment Opportunities

Private credit, a form of credit extended by asset managers to corporate and individual borrowers, has emerged as a high-performing alternative investment in recent years. Preqin estimates that the private credit market has grown from $250 billion in 2010 to $1.4 trillion in 2023. J.P. Morgan recently published an article entitled, “Can Private Credit Continue to Perform?”. It's worth taking a closer look at the key points in this article and see how they connect with our strategy at Kirkland Capital Group (KCG).

Commercial Real Estate Foreclosure in Judicial Foreclosure States: What Options Does a Lender Have?

At Kirkland Capital Group, we carefully review every loan through our due diligence process. Most loans that are submitted do not meet our standards. However, despite our proactive approach, there is still a possibility of foreclosure or property takeover. Our main priority throughout the entire process, including due diligence, loan servicing, and, if needed, foreclosure or property takeover, is to protect investor principal.

Investor Interview: Prashant Sharma

Chris Carsley, our Chief Investment Officer, had a very candid conversation with Prashant ranging from his background and experience as a Microsoft executive, to his current investment thesis and a lot more.

Kirkland Capital Group and Concreit Fireside Chat

Navigating today’s market can seem daunting to many investors. The rising interest rates, inflation, and general uncertainty of what will happen in the coming months or years have created doubt and fear among investors.

The Banking Collapse and the Impact on Private Lending

The recent banking collapse of Silicon Valley Bank, Signature Bank and Credit Suisse has impacted individuals, institutions, and industries and the effects will continue to be felt in the coming years.

Chris Carsley, our Chief Investment Officer, and Brock Freeman, our Chief Operating Officer at Kirkland Capital Group, join Left Field Investors during their Scouting Report call to talk about the recent banking collapse and the impact it has had on the private lending space and what can investors do to help mitigate risks to take advantage of the opportunities that have been created recently.

The Keys To Repeatable Alpha

Generating alpha requires an “edge” based on inefficiency in the market. But the most valuable type of alpha is that which is repeatable, and consistent.

Chris Carsley, our Chief Investment Officer and Managing Partner at Kirkland Capital Group, joins WealthChannel’s Andy Hagans to discuss how to generate alpha in a consistent manner.

How to Invest in Alternatives Like a Pro?

From the last OpenAlt conversation, I talked about the basics of Due Diligence and identify the key areas that you need to take a look at before making an investment. In this webinar, I dive into areas you need to look at for potential red flags so you can invest like how the pros do it.

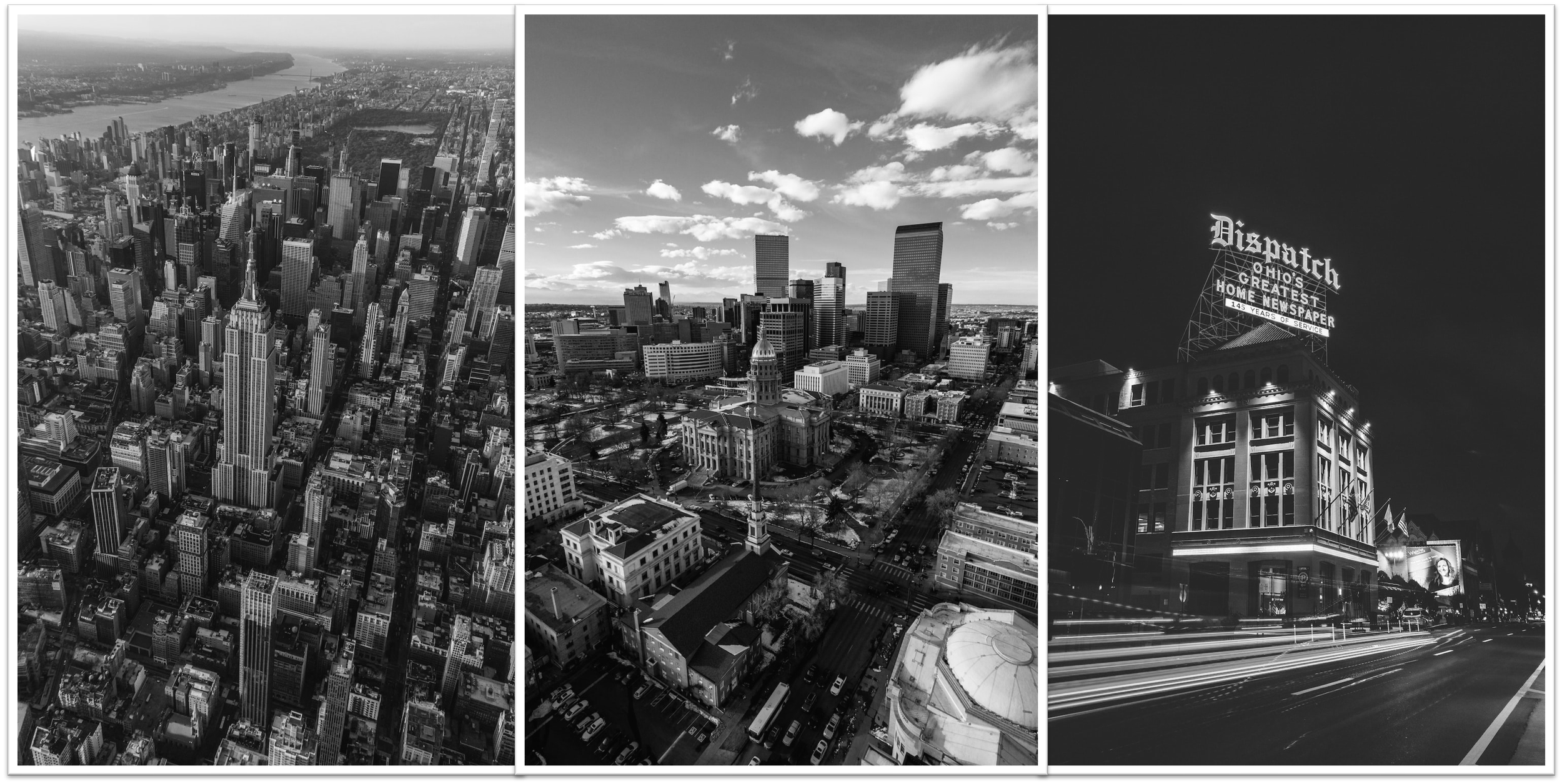

Real Estate Markets Series: What are Primary, Secondary, and Tertiary Markets

Real estate markets are categorized by the size of the population within a geographic area, as well as the availability of housing, economic activity, and job opportunities. In this series, we will explore what is considered primary, secondary, and tertiary real estate markets, as well as some of the risks and opportunities of each. We will even touch on rural markets.

Alternative Due Diligence Basics

From the last OpenAlt conversation, we talked about the importance of Diversification with Alternative Investments. But before you invest in any Alternative Investment, it’s wise to do your due diligence to make sure you are making an informed investment decision every time. In this interview, I talk about the basics of Due Diligence and identify the key areas that you need to take a look at before making an investment.

CRE Investing in Changing Market Conditions, Panel Discussion

During Verivest’s Investment Summit last November ‘22, Chris Carsley - CFA, CAIA, Chief Investment Officer (CIO) & Managing Partner at Kirkland Capital Group was one of the panelist for their session on “CRE Investing in Changing Market Conditions”

Alternative Investment Due Diligence

Hosted by Rocket Dollar, Chris Carsley - CFA, CAIA, Chief Investment Officer & Managing Partner at Kirkland Capital Group discusses his Due Diligence playbook on Alternative Investments which you can apply across different asset classes.

Why Diversify?

With AUM in alternatives expected to grow from 18% to 24% by 2025, it is the perfect time to understand what diversification is, and how this information can help you think about building a portfolio. How can alternatives potentially play a part in a diversified portfolio?

What Are Alternative Investments

Hosted by OpenAlt, Chris Carsley - CFA, CAIA, Chief Investment Officer & Managing Partner at Kirkland Capital Group discusses What are Alternative Investments. Great insights into alternatives were discussed and covered.