The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

What Are Alternative Investments

Hosted by OpenAlt, Chris Carsley - CFA, CAIA, Chief Investment Officer & Managing Partner at Kirkland Capital Group discusses What are Alternative Investments. Great insights into alternatives were discussed and covered.

Alternative Investments for Investment Advisors

Hosted by CAIA Seattle, Adam Ponder, Co-Founder and CEO of Alta Trust discusses the alternative investments for investment advisors with Chris Carsley - CFA, CAIA, Chief Investment Officer & Managing Partner at Kirkland Capital Group.

Active vs. Passive Real Estate Investing Opportunities

Alternative Investment Expert Chris Carsley and Brock Freeman talk about Active vs. Passive Real Estate Investing Opportunities with Jeff Mount on Dynamic Mapping.

Can I Still Contribute to My IRA or 401k for Last Year?

Your IRA contributions may be tax-deductible. The deduction may be limited if you or your spouse are covered by a retirement plan at work and your income exceeds certain levels.

Thrive & Canopy Multifamily Equity Investment — Fully Funded

Very excited to announce that the Canopy apartment complex is now a part of our real estate portfolio in Texas. Thrive is the second property in our two-for-one portfolio deal we shared. We are excited to expand our footprint into Phoenix/Tempe while offering a new kind of deal to our investors.

CAIA Seattle Webinar - Is Opportunity Zone Fund Investing Still Compelling?

Subchapter Z of the tax code, possibly the most compelling tax legislation in decades, coupled with a growing sea of unrealized capital gains and the potential for higher future capital gains tax rates, offers investors a significant opportunity from a planning perspective.

Alternative Investments: Investment Allocations 5 Questions to Ask

Kirkland Capital Group Chief Investment Officer Chris Carsley’s paper, Alternative Investments: Due Diligence Red Flags, was published in the prestigious CAIA Blog, Portfolio for the Future. This paper provides important, and accessible, education to investors on how to identify and vet certain red flags during the pre-investment due diligence process.

Alternative Investments For The Middle-Class Millionaire

Alternative Investment Expert Chris Carsley talks about Alternative Investment for the middle-class millionaire with Jeff Mount on Dynamic Mapping.

Taking a Vision and Making It Reality with Chris Carsley and Brock Freeman

Kirkland Capital Group objective is to provide a high yield principal preservation focused fixed income return to help build and fortify wealth for our investors across USA. Watch the managing partners: Brock and Chris as they share their vision and how they made it a reality.

Dive into Private Investment Due Diligence with a Guided Tour of the PPM

Identify key aspects of a and define what fits your investment goals so you can pull that information quickly from the document and determine if you need to read further. Get to the “No” quickly so you can move to a better opportunity.

Watch Chris Carsley walk you through the private placement memorandum and the due diligence it requires to invest with confidence.

4 Factors to Help You Avoid a Disappointing Private Alternative Investment

Private alternative investments are a powerful way to build your wealth. However, like other powerful tools there is risk if the user manual is not read, and the proper precautions are not taken before using. Understanding how to look at the selection of tools available, assess, and select the right one for your need is critical. Good ones build and protect your wealth more efficiently; the wrong one can do much harm to your wealth (and even your health).

In this webinar hosted by Verivest, alternative fund expert Chris Carsley and his partner at Kirkland Capital Group, Brock Freeman, walk through four important areas to equip you in assessing a private alternative investment fund. The documents (the fund’s “user manual”), fees (what will you be charged), fund operation risk (can hackers steal your money), and transparency (or do you know what your fund manager is really doing with your money).

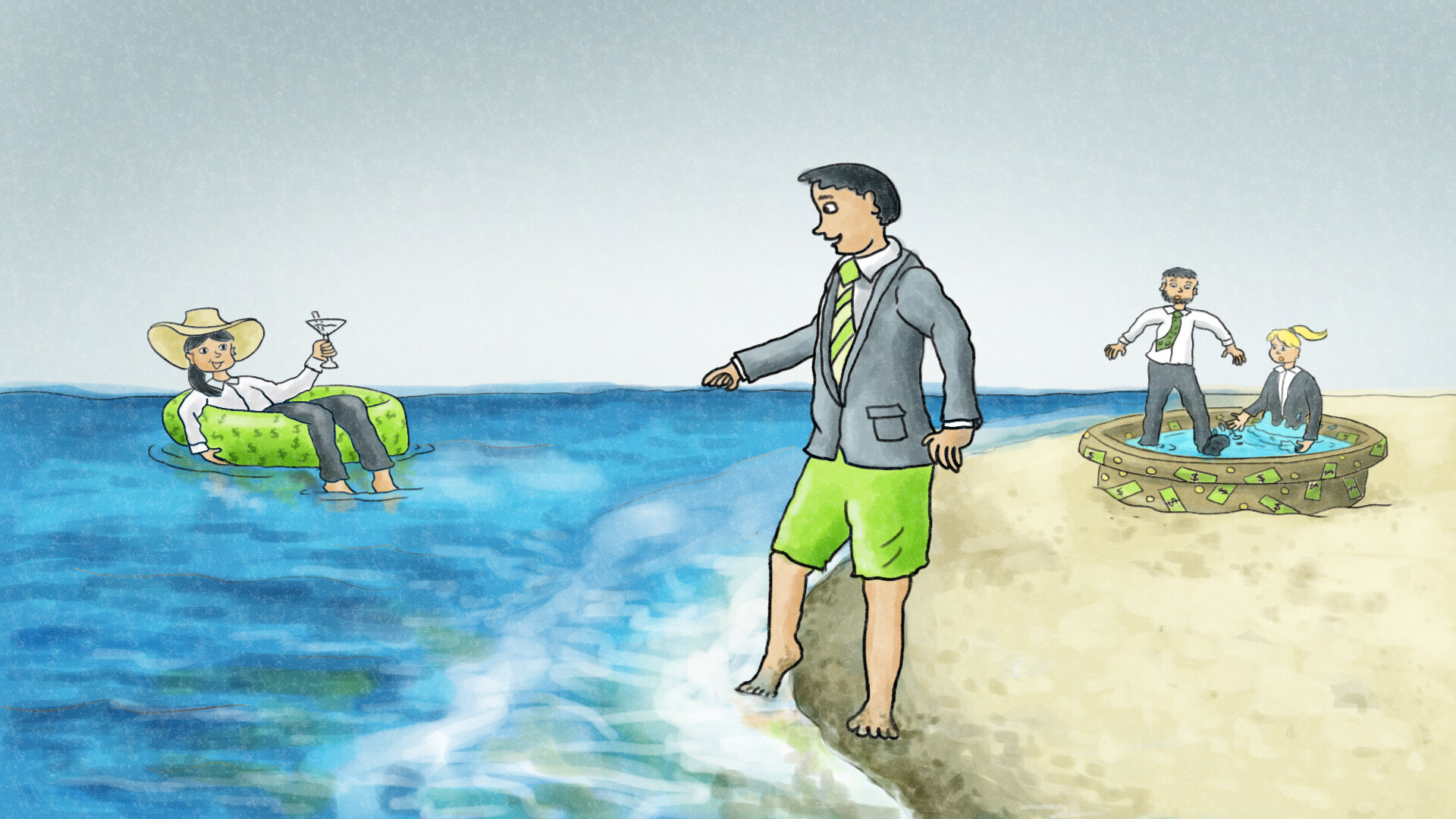

3 Ways the Rich Get Richer with Private Alternative Investments, and How You Can Too

As a newly qualified accredited investor, you may be asking yourself “what is the next step for my investment portfolio?”

Let’s look at two university classmates, Annie and Tom, who have had similar successful tech industry roles, similar household income, and comparable living costs. It’s now the future and both are turning 50 this year. Annie is, along with her spouse, retiring this year as they have enough income from investments to replace the income from their jobs; they are financially independent. Tom and his spouse, on the other hand, are making standard progress in their retirement investments, but are years away from having enough investment income to retire.

Understanding “Micro-Balance” Bridge Lending

Most lenders do not consider commercial real estate bridge loans under $1M. That’s where Kirkland Capital Group enters the picture. They’ve leveraged this opportunity by building the Kirkland Income Fund, delivering a “micro-balance" commercial mortgage option. Chris Carsley and Brock Freeman of Kirkland join Lance to talk about the ins and outs: how the Fund offers investors lower risk and consistent annual fixed income returns, how they approach the underwriting process, commercial mortgage brokers, and assessing borrower risk.

Tap into Retirement Plan Dollars for Alternative Asset Investing

Hosted by CAIA Seattle, John Paul Ruiz of The Entrust Group shows how you can unlock the power of retirement plan capital for investing in alternative investments. There are 33 trillion dollars in retirement plans. Whether you are an advisor helping clients or an individual investor learn about the platforms available, rules and regulations, and how to get started in a broader utilization of your retirement plan assets.

2021 March—Rising Optimism 💪🏼

Kirkland Capital Group approved as a Verivest Verified Gold Sponsor

Kirkland Capital Group is happy to announce that we are officially a Gold member of the Verivest Sponsor Network! We are committed to trust and transparency, helping you invest your hard-earned money with peace of mind.

8 Factors to Determine If an Investment Fund Manager Is Putting Investors First

Lots of managers say, "Investor First," but it is only when you dig into the fund documentation and really spend time understanding the management team, fees, and fund details can you better assess if this is the case. Regardless of the investment platform, here are eight factors for investors to consider when reviewing fund managers to see if they are putting investors first.

2021 February—Are We Seeing Stabilization?

National vacancy rates were 4.5%; but net absorption of multifamily units was clearly weaker than last year. Many suburban and smaller markets have seen rent increases.

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.