Why Traditional Investment Diversification May No Longer Be Enough

Private debt has historically been a source of yield that has low correlation to traditional asset classes. Due to the current condition of the market, more investors are asking us about building a resilient personal investment portfolio, and how diversification and correlation figure into that resilience. Let’s see what we can learn from how Institutional Investors are doing in today's market conditions.

The following paragraphs summarize key points related to diversification published on the CAIA Association website in an article on Institutional Investors' Portfolio Design[1].

Institutional investors have been caught off guard with the resurgence of inflation in recent months. After a prolonged period of low interest rates, supportive central bank policies and rising asset prices, inflation poses a significant risk to their portfolios. According to a recent survey of nearly 400 institutional investors, over a third (34%) identified inflation as the biggest threat to their portfolios in the next 12 months. This is a significant increase compared to the next biggest risk, central bank tapering, which was identified by only 12% of investors.

The current inflation rate is a cause for concern. The USA's inflation rate, as measured by the Consumer Price Index (CPI), stood at 6.2% at the time of the survey. However, by June 2022, it had risen to 9.1%. December Inflation, although lower than June, was still relatively high at 6.5%. Inflation in the UK is predicted to reach double digits later this year, and similar or higher rates of inflation are also widespread globally. In light of this, central banks, led by the Federal Reserve, have started to withdraw expansionary policies and increase interest rates, which is likely to slow economic growth and bring on a recession.

Additionally, geopolitical risks have become more prominent in 2022 following Russia's invasion of Ukraine. Given these deteriorating conditions, it is not surprising that bubbles in technology stocks and cryptocurrencies burst in 2022 as markets reacted to the macroeconomic and geopolitical outlook. These risks pose a significant stress-test for institutional investors' portfolios moving forward.

Given the current environment, traditional 60/40 portfolio models may not be sufficient to navigate these challenges. Depending on their investment objectives, risk tolerance, resources and expertise, institutional investors have developed different portfolio models that fit their needs, most of which include incorporating alternative investments into their portfolio.

For instance, many endowments and foundations adopt the approach set out by David Swensen at Yale, which involves diversifying away from listed equities and bonds by allocating to a range of alternative and real assets. This approach aims to achieve more diversified returns and has been successful in generating impressive returns in recent years. 30% of investors surveyed said that the "endowment model" provided the best chance of good risk-adjusted returns over the medium to long-term. This approach is more popular than the conventional 60/40 portfolio split between equities and fixed income, which was selected by 20% of investors.

Another approach that has gained popularity among institutional investors is making direct investments in assets such as private equity, real estate, and infrastructure. This approach, pioneered by some large Canadian institutions, is designed for very large institutions with a long-term outlook but also a desire to lessen their exposure to listed market volatility. These investors have the scale and resources needed to build in-house teams capable of managing direct investments in asset classes such as private equity and real estate, and to negotiate favorable terms when they decide to invest.

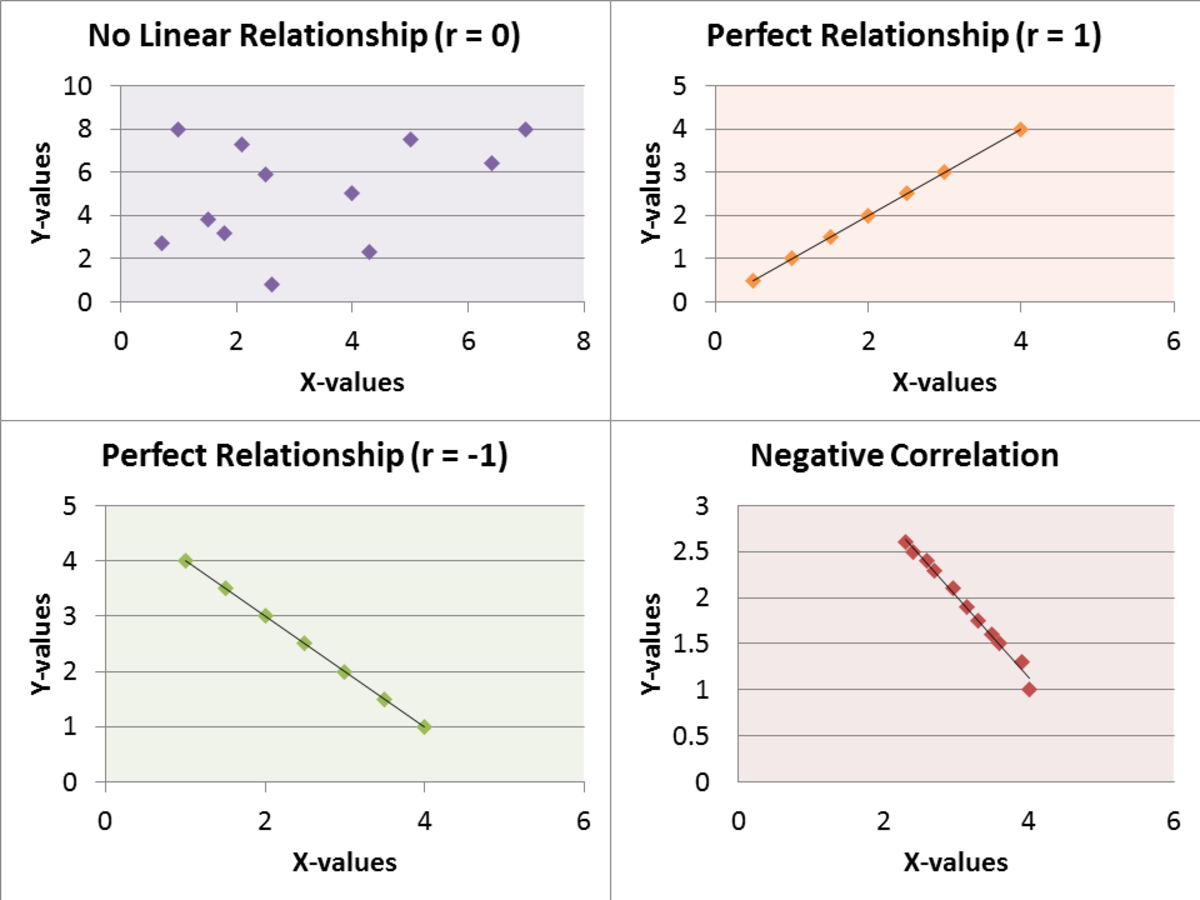

One important aspect to consider when diversifying is correlation. Correlation is a statistical measure of how two assets move in relation to each other. A correlation of 1 means that two assets move in perfect synchronization, while a correlation of -1 means that they move in opposite directions.

Here are examples of different types of correlation:

Traditionally we were taught that a diversified portfolio was investing in stocks and bonds that historically moved in opposite directions. However, in times of high volatility, stocks and bonds have moved in the same direction, which is why investing only in these cannot be considered real diversification. This is very apparent in the current market conditions that we are experiencing as both asset classes have taken a beating in 2022. Therefore, to truly have a diversified portfolio, it is no longer enough to just look at the traditional asset types, geographical location, or industry. One must also consider investments in asset classes with different risk factors and a low correlation with stocks and bonds, like alternative investments.

In conclusion, like institutional investors, we must review our portfolio models and investment approaches considering the current inflation and geopolitical risks. Diversification through alternative investments is a strategy worth considering as it can help manage some of these risks and achieve more diversified returns given its low correlation to stocks and bonds.

Note: We want to learn from institutional investors’ process, but understand not every structure that works for an institution will work for individual investors. One must take into account one's personal investment goals and liquidity requirements.

About the Kirkland Income Fund

The Kirkland Income Fund is a principal preservation focused passive high-yield income fund. The fund has delivered over 11% net returns for 2022 while using no leverage. Investors feel good that while doing well, they are doing good, with the Fund’s micro-balance commercial real estate loans used to rehabilitate middle-income affordable housing and neighborhoods, making a positive social and environmental impact. Kirkland Capital Group, the Fund’s Manager, combines 75+ years of investment management, real estate, and technology to Build and Fortify Your Wealth.

[1] Investing in a Time of Rising Inflation, January 2022, Matthew Craig of CoreData Research