The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 1

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 3

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 20

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

- Foreclosure 1

- Form 1099 1

- Formidium 1

- Fund Management 5

- Funds 2

- IRA 1

Access Our Exclusive Investment Insights.

Real Estate Markets Series: What are Primary, Secondary, and Tertiary Markets

Real estate markets are categorized by the size of the population within a geographic area, as well as the availability of housing, economic activity, and job opportunities. In this series, we will explore what is considered primary, secondary, and tertiary real estate markets, as well as some of the risks and opportunities of each. We will even touch on rural markets.

Why Traditional Investment Diversification May No Longer Be Enough

Private debt has historically been a source of yield that has low correlation to traditional asset classes. Due to the current condition of the market, more investors are asking us about building a resilient personal investment portfolio, and how diversification and correlation figure into that resilience. Let’s see what we can learn from how Institutional Investors are doing in today's market conditions.

The following paragraphs summarize key points related to diversification published on the CAIA Association website in an article on Institutional Investors' Portfolio Design[1].

Deducting Your Real Estate Start-Up Costs

Treatment of start-up costs per U.S. GAAP and the Internal Revenue Service (IRS)

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

The Importance of Valuations for Alternative Investments

Kirkland Capital Group Chief Investment Officer Chris Carsley’s paper, The Importance of Valuations for Alternative Investments, was published in the prestigious CAIA Blog, Portfolio for the Future. This paper provides important and accessible, education to investors on How is the Accuracy of Investment Valuations Important? Fair Value Measurement and Valuation Best Practices.

Can I Still Contribute to My IRA or 401k for Last Year?

Your IRA contributions may be tax-deductible. The deduction may be limited if you or your spouse are covered by a retirement plan at work and your income exceeds certain levels.

Thrive & Canopy Multifamily Equity Investment — Fully Funded

Very excited to announce that the Canopy apartment complex is now a part of our real estate portfolio in Texas. Thrive is the second property in our two-for-one portfolio deal we shared. We are excited to expand our footprint into Phoenix/Tempe while offering a new kind of deal to our investors.

Alternative Investments: Investment Allocations 5 Questions to Ask

Kirkland Capital Group Chief Investment Officer Chris Carsley’s paper, Alternative Investments: Due Diligence Red Flags, was published in the prestigious CAIA Blog, Portfolio for the Future. This paper provides important, and accessible, education to investors on how to identify and vet certain red flags during the pre-investment due diligence process.

Alternative Investments: Due Diligence Red Flags

Kirkland Capital Group Chief Investment Officer Chris Carsley’s paper, Alternative Investments: Due Diligence Red Flags, was published in the prestigious CAIA Blog, Portfolio for the Future. This paper provides important, and accessible, education to investors on how to identify and vet certain red flags during the pre-investment due diligence process.

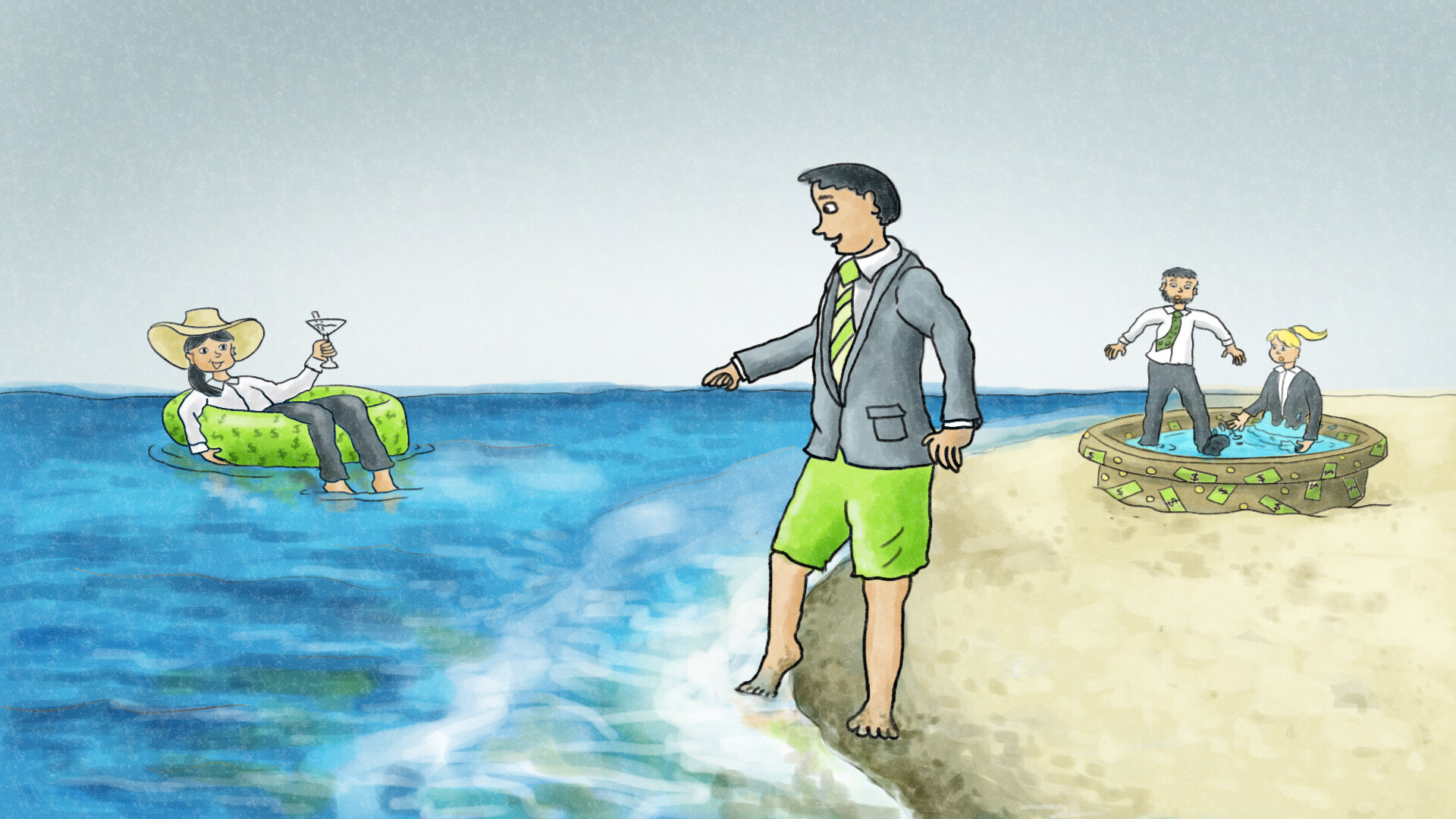

3 Ways the Rich Get Richer with Private Alternative Investments, and How You Can Too

As a newly qualified accredited investor, you may be asking yourself “what is the next step for my investment portfolio?”

Let’s look at two university classmates, Annie and Tom, who have had similar successful tech industry roles, similar household income, and comparable living costs. It’s now the future and both are turning 50 this year. Annie is, along with her spouse, retiring this year as they have enough income from investments to replace the income from their jobs; they are financially independent. Tom and his spouse, on the other hand, are making standard progress in their retirement investments, but are years away from having enough investment income to retire.

2021 March—Rising Optimism 💪🏼

8 Factors to Determine If an Investment Fund Manager Is Putting Investors First

Lots of managers say, "Investor First," but it is only when you dig into the fund documentation and really spend time understanding the management team, fees, and fund details can you better assess if this is the case. Regardless of the investment platform, here are eight factors for investors to consider when reviewing fund managers to see if they are putting investors first.

2021 February—Are We Seeing Stabilization?

National vacancy rates were 4.5%; but net absorption of multifamily units was clearly weaker than last year. Many suburban and smaller markets have seen rent increases.

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

Not yet ready to go direct with Kirkland Capital Group? You can still invest 👌

Does this sound like you: I’d like to take advantage of the higher returns and lower risk of passive real estate investment; however, I’m not ready to commit the required amount of money for a year to a private real estate investment fund.

The good news, you have a choice.

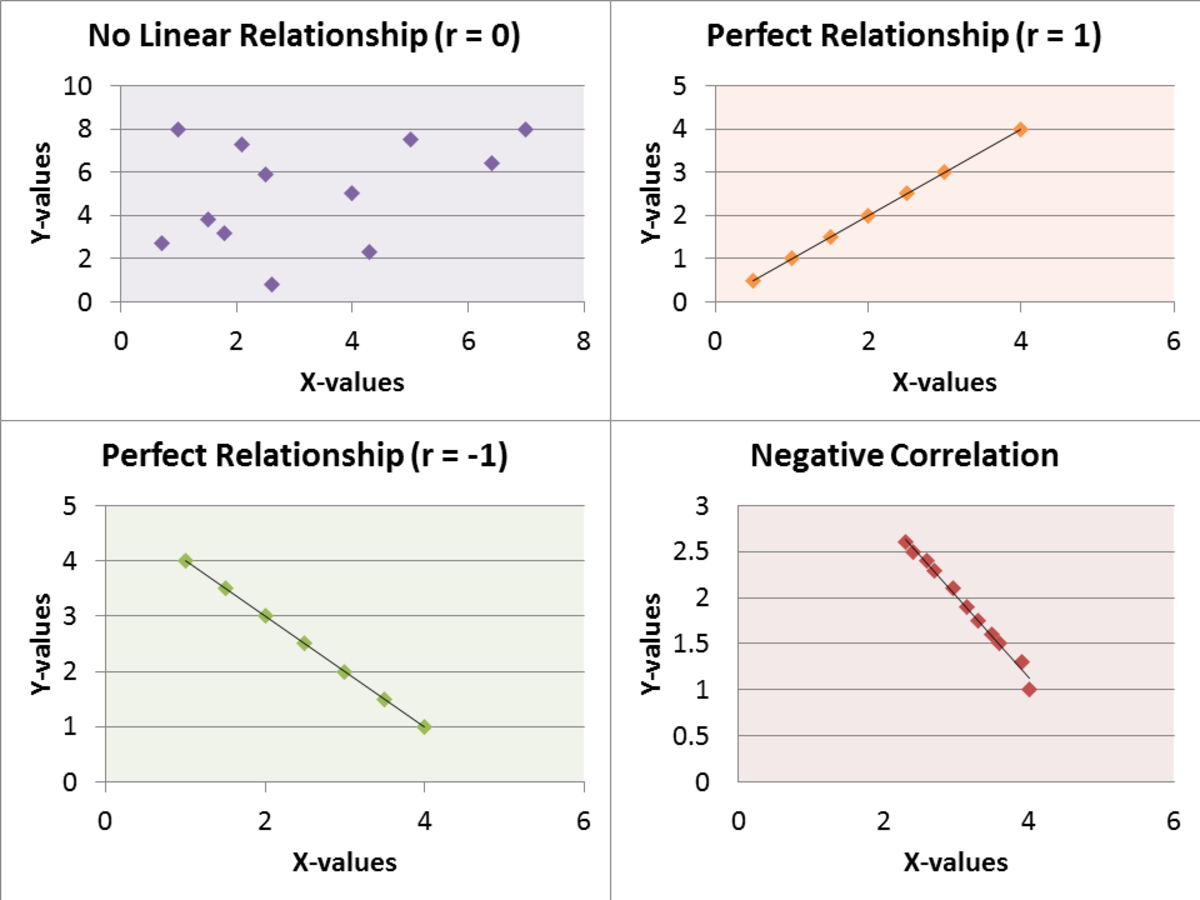

Correlation and the Impact on an Investment Portfolio

How do I know if my investments or the ones I intend to include to my portfolio would help diversification? It is simple – understand the relationship between the investments.

2021 January — Are Alternatives the Answer to Avoiding the Bleak Outlook for Stocks & Bonds?

Research firms in Wall Street have expressed concerns for lower returns for both fixed income and equities in 2021. Credit and emerging market debt remain brighter spots, but increasingly it is to alternative assets investors must turn to find higher returns.

Kirkland Income Fund Listed on Park Place Investment

Park Place Investment has teamed up with Kirkland Capital Group to make the Kirkland Income Fund available on their online crowdfunding platform specializing in commercial real estate.

The Solo 401k Plan – The Power to Invest in Commercial Real Estate Equity and Debt

The Solo 401k Retirement Plan offers powerful advantages for real estate investors. A Solo 401k Plan (also known as Individual 401k) is an IRS-approved Qualified Retirement Plan that has been simplified for the self-employed and those who own a small business. The structure of the plan gives participants more options than a conventional 401k. The Solo 401k’s unlimited investment capability, loan feature, and tax benefits make it the perfect vehicle for investing in real estate.

2020 December Update - An Interesting Year?

The November Kirkland Income Fund results ended strong. With increased efficiency of utilized capital, cost controls, and continued performing status of our portfolio loans the fund reported its strongest month yet with a net return to investors of 0.85%. Acceptance to an institutional investment platform has increased new investor capital. Investor interest has continued to grow as the fund continues to perform well. We are looking forward to a strong 2021.