The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

Alternative Investments: Due Diligence Red Flags

Kirkland Capital Group Chief Investment Officer Chris Carsley’s paper, Alternative Investments: Due Diligence Red Flags, was published in the prestigious CAIA Blog, Portfolio for the Future. This paper provides important, and accessible, education to investors on how to identify and vet certain red flags during the pre-investment due diligence process.

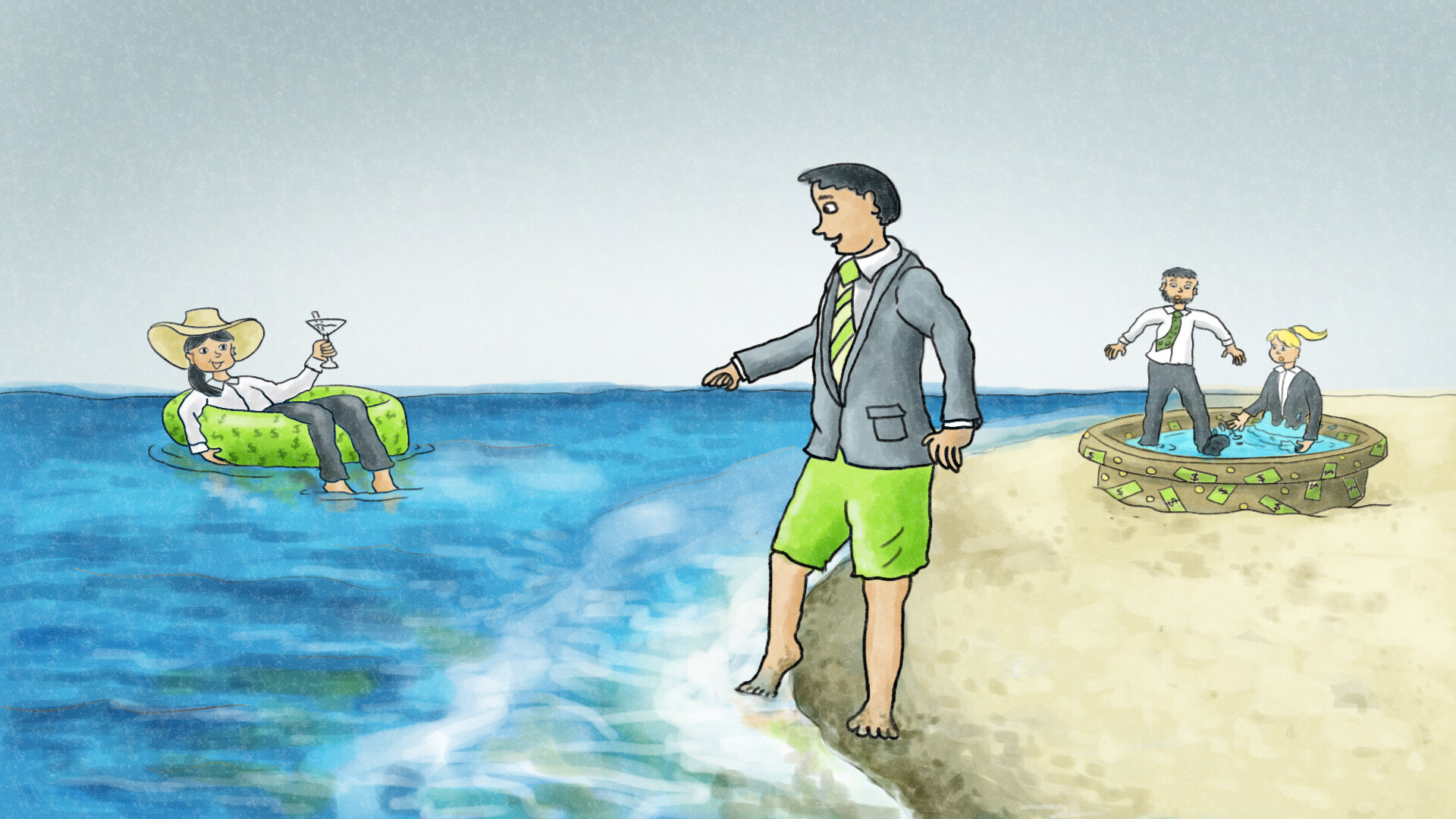

3 Ways the Rich Get Richer with Private Alternative Investments, and How You Can Too

As a newly qualified accredited investor, you may be asking yourself “what is the next step for my investment portfolio?”

Let’s look at two university classmates, Annie and Tom, who have had similar successful tech industry roles, similar household income, and comparable living costs. It’s now the future and both are turning 50 this year. Annie is, along with her spouse, retiring this year as they have enough income from investments to replace the income from their jobs; they are financially independent. Tom and his spouse, on the other hand, are making standard progress in their retirement investments, but are years away from having enough investment income to retire.

2021 March—Rising Optimism 💪🏼

8 Factors to Determine If an Investment Fund Manager Is Putting Investors First

Lots of managers say, "Investor First," but it is only when you dig into the fund documentation and really spend time understanding the management team, fees, and fund details can you better assess if this is the case. Regardless of the investment platform, here are eight factors for investors to consider when reviewing fund managers to see if they are putting investors first.

2021 February—Are We Seeing Stabilization?

National vacancy rates were 4.5%; but net absorption of multifamily units was clearly weaker than last year. Many suburban and smaller markets have seen rent increases.

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

Not yet ready to go direct with Kirkland Capital Group? You can still invest 👌

Does this sound like you: I’d like to take advantage of the higher returns and lower risk of passive real estate investment; however, I’m not ready to commit the required amount of money for a year to a private real estate investment fund.

The good news, you have a choice.

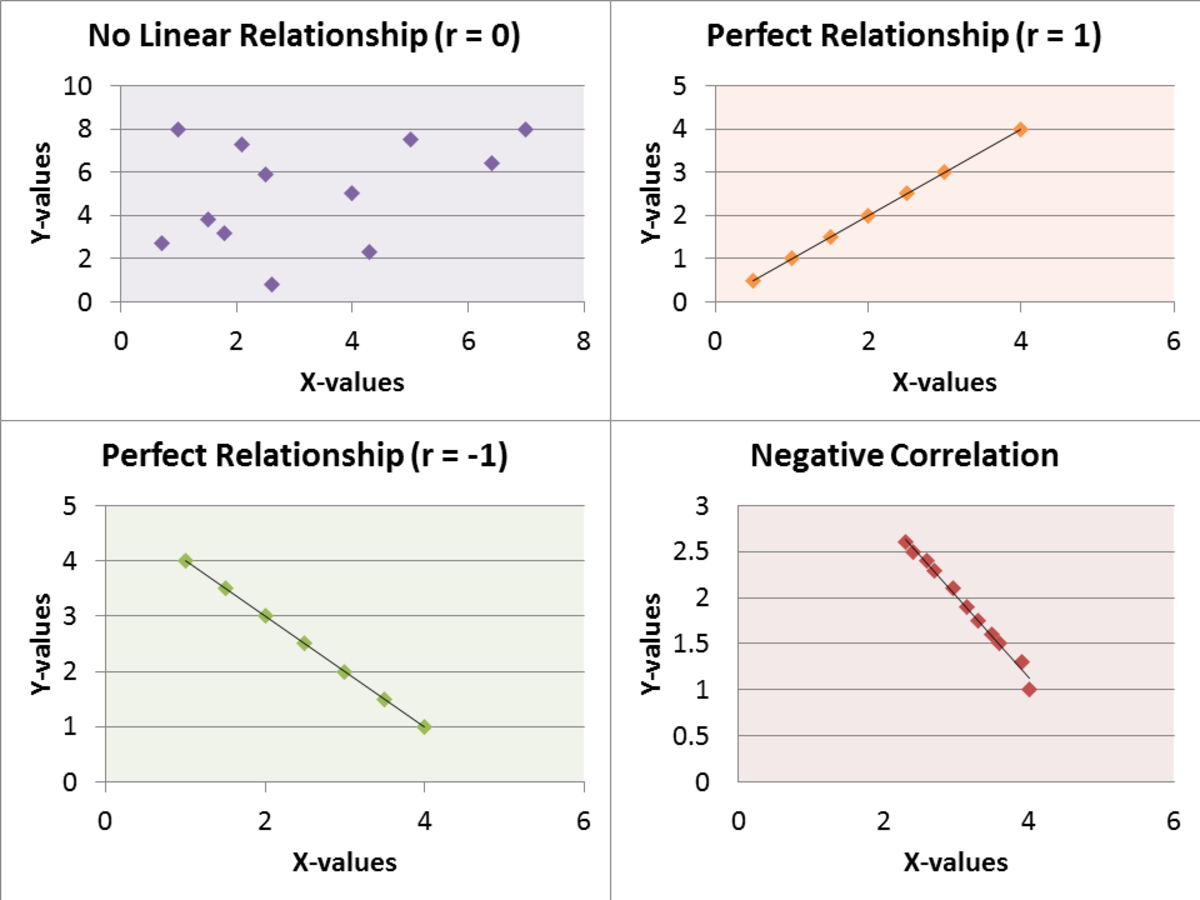

Correlation and the Impact on an Investment Portfolio

How do I know if my investments or the ones I intend to include to my portfolio would help diversification? It is simple – understand the relationship between the investments.

2021 January — Are Alternatives the Answer to Avoiding the Bleak Outlook for Stocks & Bonds?

Research firms in Wall Street have expressed concerns for lower returns for both fixed income and equities in 2021. Credit and emerging market debt remain brighter spots, but increasingly it is to alternative assets investors must turn to find higher returns.

Kirkland Income Fund Listed on Park Place Investment

Park Place Investment has teamed up with Kirkland Capital Group to make the Kirkland Income Fund available on their online crowdfunding platform specializing in commercial real estate.

The Solo 401k Plan – The Power to Invest in Commercial Real Estate Equity and Debt

The Solo 401k Retirement Plan offers powerful advantages for real estate investors. A Solo 401k Plan (also known as Individual 401k) is an IRS-approved Qualified Retirement Plan that has been simplified for the self-employed and those who own a small business. The structure of the plan gives participants more options than a conventional 401k. The Solo 401k’s unlimited investment capability, loan feature, and tax benefits make it the perfect vehicle for investing in real estate.

2020 December Update - An Interesting Year?

The November Kirkland Income Fund results ended strong. With increased efficiency of utilized capital, cost controls, and continued performing status of our portfolio loans the fund reported its strongest month yet with a net return to investors of 0.85%. Acceptance to an institutional investment platform has increased new investor capital. Investor interest has continued to grow as the fund continues to perform well. We are looking forward to a strong 2021.

2020 November Update - Which Data is Correct?

Many major Real Estate services are posting data and of course none of them have the same numbers. This is common in most data and indices created to track occurrences in a variety of markets. One must remember one of the reasons bridge financing exists is the fragmented commercial lending industry. This fragmentation is a major driver to why you can read one article that claims everything seems stable in real estate, then a different report which shows dramatically worse metrics. The “facts” of the data depends on where one is looking, and the attribution of the factors being tracked.

2020 October Update - Trick or Treat?

The multifamily sector continues to show resiliency. Vacancy rates have only risen 0.6% year over year to a current 4.6%. Rental rates have softened only 0.6% year over year as well. Most of this rental softening has been seen in the coastal cities while less expensive markets have shown stabilization.

But, just like those trick or treaters, we are wondering what's behind the door.

When Your 1031 Exchange is in Trouble

When Your 1031 Exchange is in Trouble, don't buy a property you would not buy if you were not under time pressure. There are other Capital Gains Tax Deferral options available to you.

2020 September Update - Opportunity

Relative to its peers and in a measure of absolute return the broad REIT market has had its worst performing period in 10 years. Regardless of this negative event, commercial real estate debt funds focused on multifamily have been performing well and continue to receive requests for loans that are supported by solid properties and borrowers. We at Kirkland Capital Group are on our toes and ready to move as a reversion in the coming years will certainly create more opportunities.

2020 August Update - Head Winds

July has been an amazing month with increased deal flow from multiple sources. Kirkland Capital Group closed another loan with many more in the pipeline. Buyers and investors in the small balance commercial real estate arena have come out strong, and according to many of the brokers in our network they are seeing more activity that will certainly carry into the months to come. In lock step KCG has had more interest from investors as well.

2020 July Update - Long Dark Tunnel, but We Have Torches

Fixed income investments are “Superman” and the current market environment is Kryptonite. The world is in massive debt and the economy is looking at a long recovery period. None of these factors imply interest rates will be rising anytime soon. “Superman” is in real trouble and no immediate help is available.