2020 September Update - Opportunity

The Fund had a strong August month with three new loans being completed. One previous KCG loan was paid off at the end of the month and we have already deployed those funds into a new loan. We continue to throw a wide net in sourcing loans including building a commercial loan broker network. We are also actively working on developing broader banking relations in geographical areas of opportunity.

Gross rates on multifamily loans are still 11 to 12% and we do not see that changing in the near term. We have also continued to require six months of interest prepaid at time of closing.

A big change is the Fund is now in the process of on boarding a Fund Administrator, on track to be completed in September. At a high level the Fund Administrator augments middle and back office operations while also providing an investor portal. The portal will allow investors to review statements, newsletters, research created by Kirkland Capital group, and transparency into the properties our loans are written against.

10 Year Asset Class Returns

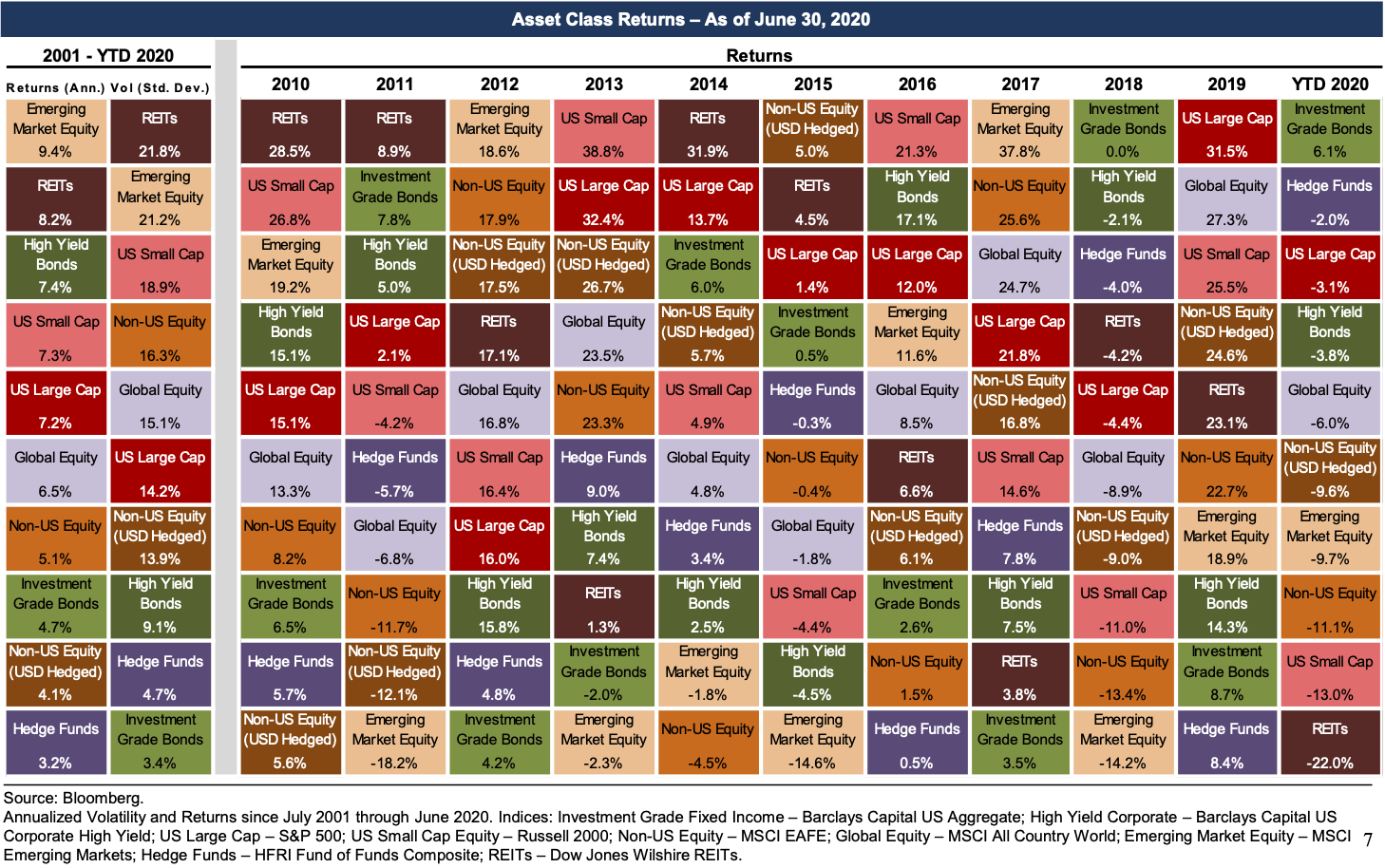

I wanted to share the chart below so you can have a quick view into how various types of investments have been performing for the last ten years. I believe in the mathematical tendency of markets to revert. You may have studied this as a “reversion to the mean”. As seen in the chart below, if a style of investment performs poorly or well in relation to other investment classes it generally adjusts positively or negatively respectively in following periods.

We could spend many hours just walking through this chart discussing the myriad of factors that caused this chart to look the way it does, but I would like to point out that relative to its peers and in a measure of absolute return the broad REIT market has had its worst performing period in 10 years. Regardless of this negative event, Kirkland Capital has been performing well and continues to receive requests for loans that are supported by solid properties and borrowers. We are on our toes and ready to move as a reversion in the coming years will certainly create more opportunities for our Fund.

Commercial Real Estate Updates

Rent collection: Multifamily rent collections continued to fall in August. With that said, the collection rate is still 92.1% according to the NMHC. As a benchmark, August 2019 was 94%.

Cares Act: The original stipend is over, and August seemed to weather the loss of the additional unemployment funds. Federal support of $300 a week has been authorized and President Trump has asked the States to supply an additional $100 a week. As of August 31st, only Arizona, Louisiana, Missouri, Tennessee, and Texas have been delivering State assistance. NMHC forecasts that rent collections will continue to fall in September.

Eviction Law: The CDC has used its “quarantine authority” to halt evictions until December 31, 2020. Individuals earning less than $99,000 a year and couples earning less than 198,000 a year are eligible. However, tenants would not be forgiven rents nor forgiven charges associated with late pay or non-payment.