The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 3

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 5

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 22

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

- Foreclosure 1

- Form 1099 1

- Formidium 1

- Fund Management 5

- Funds 2

- IRA 1

Access Our Exclusive Investment Insights.

Commercial Real Estate Foreclosure in Judicial Foreclosure States: What Options Does a Lender Have?

At Kirkland Capital Group, we carefully review every loan through our due diligence process. Most loans that are submitted do not meet our standards. However, despite our proactive approach, there is still a possibility of foreclosure or property takeover. Our main priority throughout the entire process, including due diligence, loan servicing, and, if needed, foreclosure or property takeover, is to protect investor principal.

Identifying Market Inefficiencies and Manager Edge

Chris Carsley, our Chief Investment Officer, joins Rocket Dollar for another webinar. He talks about how to identify market inefficiencies to develop an edge that can consistently generate excess returns and more importantly, is repeatable. To understand the concepts better, he uses KCG as an example to identify the market inefficiencies we are targeting and how we are able to build our edge and ultimately help define our strategy.

How to perform due diligence like a pro?

Chris Carsley, our Chief Investment Officer, joins IRA Club for another webinar. He talks about how to perform due diligence like a pro with insights from industry professionals on their non-negotiables when evaluating an investment opportunity. If you want to level up your investment due diligence, you should not miss this video!

PeerStreet Lending Platform Failure

This has been a tough and unexpected market for many in private lending. When cheap capital dries up, operations that are not sound and are run by inexperienced management are sure to fail. Recently, PeerStreet, a Fintech platform offering private debt for real estate, filed for Chapter 11 Bankruptcy. They claimed to be the "first accessible distressed-debt investment platform," but their portfolio consisted of many other forms of loans. They acted as a broker, sourcing loans and matching them with lenders and investors on their platform, and maintained servicing in-house.

The Triple Net Return (NNN): Measuring your investment return in an inflationary environment

Most investors haven’t had to deal with the impact of inflation on their investment returns. Looking at the triple net of investment (NNN) returns will give you a better return profile on your investments.

Is the sky really falling for Commercial Real Estate? How are the challenges in Commercial Real Estate affecting the Kirkland Income Fund?

It is hard to look at news feeds on the web or turn on the TV and not hear about how Commercial Real Estate is all going to collapse. We also have been having many discussions with some current but mostly new investors about commercial property loans and CMBS debt cliffs, and the imminent doom of commercial real estate.

Investor Interview: Prashant Sharma

Chris Carsley, our Chief Investment Officer, had a very candid conversation with Prashant ranging from his background and experience as a Microsoft executive, to his current investment thesis and a lot more.

Kirkland Capital Group and Concreit Fireside Chat

Navigating today’s market can seem daunting to many investors. The rising interest rates, inflation, and general uncertainty of what will happen in the coming months or years have created doubt and fear among investors.

The Banking Collapse and the Impact on Private Lending

The recent banking collapse of Silicon Valley Bank, Signature Bank and Credit Suisse has impacted individuals, institutions, and industries and the effects will continue to be felt in the coming years.

Chris Carsley, our Chief Investment Officer, and Brock Freeman, our Chief Operating Officer at Kirkland Capital Group, join Left Field Investors during their Scouting Report call to talk about the recent banking collapse and the impact it has had on the private lending space and what can investors do to help mitigate risks to take advantage of the opportunities that have been created recently.

The Keys To Repeatable Alpha

Generating alpha requires an “edge” based on inefficiency in the market. But the most valuable type of alpha is that which is repeatable, and consistent.

Chris Carsley, our Chief Investment Officer and Managing Partner at Kirkland Capital Group, joins WealthChannel’s Andy Hagans to discuss how to generate alpha in a consistent manner.

How to Invest in Alternatives Like a Pro?

From the last OpenAlt conversation, I talked about the basics of Due Diligence and identify the key areas that you need to take a look at before making an investment. In this webinar, I dive into areas you need to look at for potential red flags so you can invest like how the pros do it.

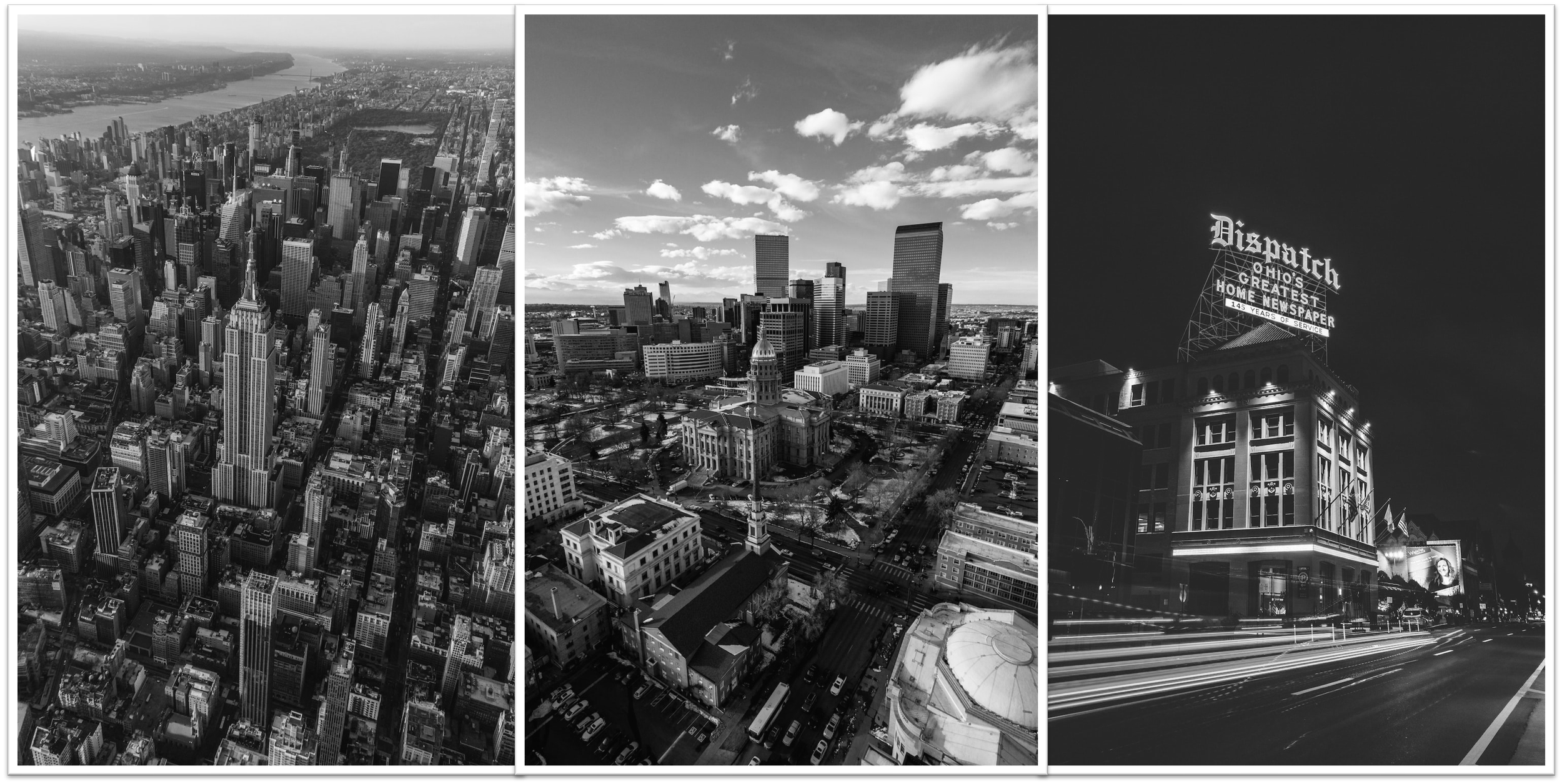

Real Estate Markets Series: What are Primary, Secondary, and Tertiary Markets

Real estate markets are categorized by the size of the population within a geographic area, as well as the availability of housing, economic activity, and job opportunities. In this series, we will explore what is considered primary, secondary, and tertiary real estate markets, as well as some of the risks and opportunities of each. We will even touch on rural markets.

Why Traditional Investment Diversification May No Longer Be Enough

Private debt has historically been a source of yield that has low correlation to traditional asset classes. Due to the current condition of the market, more investors are asking us about building a resilient personal investment portfolio, and how diversification and correlation figure into that resilience. Let’s see what we can learn from how Institutional Investors are doing in today's market conditions.

The following paragraphs summarize key points related to diversification published on the CAIA Association website in an article on Institutional Investors' Portfolio Design[1].

Alternative Due Diligence Basics

From the last OpenAlt conversation, we talked about the importance of Diversification with Alternative Investments. But before you invest in any Alternative Investment, it’s wise to do your due diligence to make sure you are making an informed investment decision every time. In this interview, I talk about the basics of Due Diligence and identify the key areas that you need to take a look at before making an investment.

CRE Investing in Changing Market Conditions, Panel Discussion

During Verivest’s Investment Summit last November ‘22, Chris Carsley - CFA, CAIA, Chief Investment Officer (CIO) & Managing Partner at Kirkland Capital Group was one of the panelist for their session on “CRE Investing in Changing Market Conditions”

Alternative Investment Due Diligence

Hosted by Rocket Dollar, Chris Carsley - CFA, CAIA, Chief Investment Officer & Managing Partner at Kirkland Capital Group discusses his Due Diligence playbook on Alternative Investments which you can apply across different asset classes.

Deducting Your Real Estate Start-Up Costs

Treatment of start-up costs per U.S. GAAP and the Internal Revenue Service (IRS)

Why Diversify?

With AUM in alternatives expected to grow from 18% to 24% by 2025, it is the perfect time to understand what diversification is, and how this information can help you think about building a portfolio. How can alternatives potentially play a part in a diversified portfolio?

Is the 60/40 Investment Portfolio Dead?

Many experts now believe that the 60/40 portfolio is no longer an investment strategy that generates the best growth profits, but there is an alternative.

The Importance of Valuations for Alternative Investments

Kirkland Capital Group Chief Investment Officer Chris Carsley’s paper, The Importance of Valuations for Alternative Investments, was published in the prestigious CAIA Blog, Portfolio for the Future. This paper provides important and accessible, education to investors on How is the Accuracy of Investment Valuations Important? Fair Value Measurement and Valuation Best Practices.