The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

How We Built an AI Prompt to Help Investors Perform Due Diligence on Private Funds

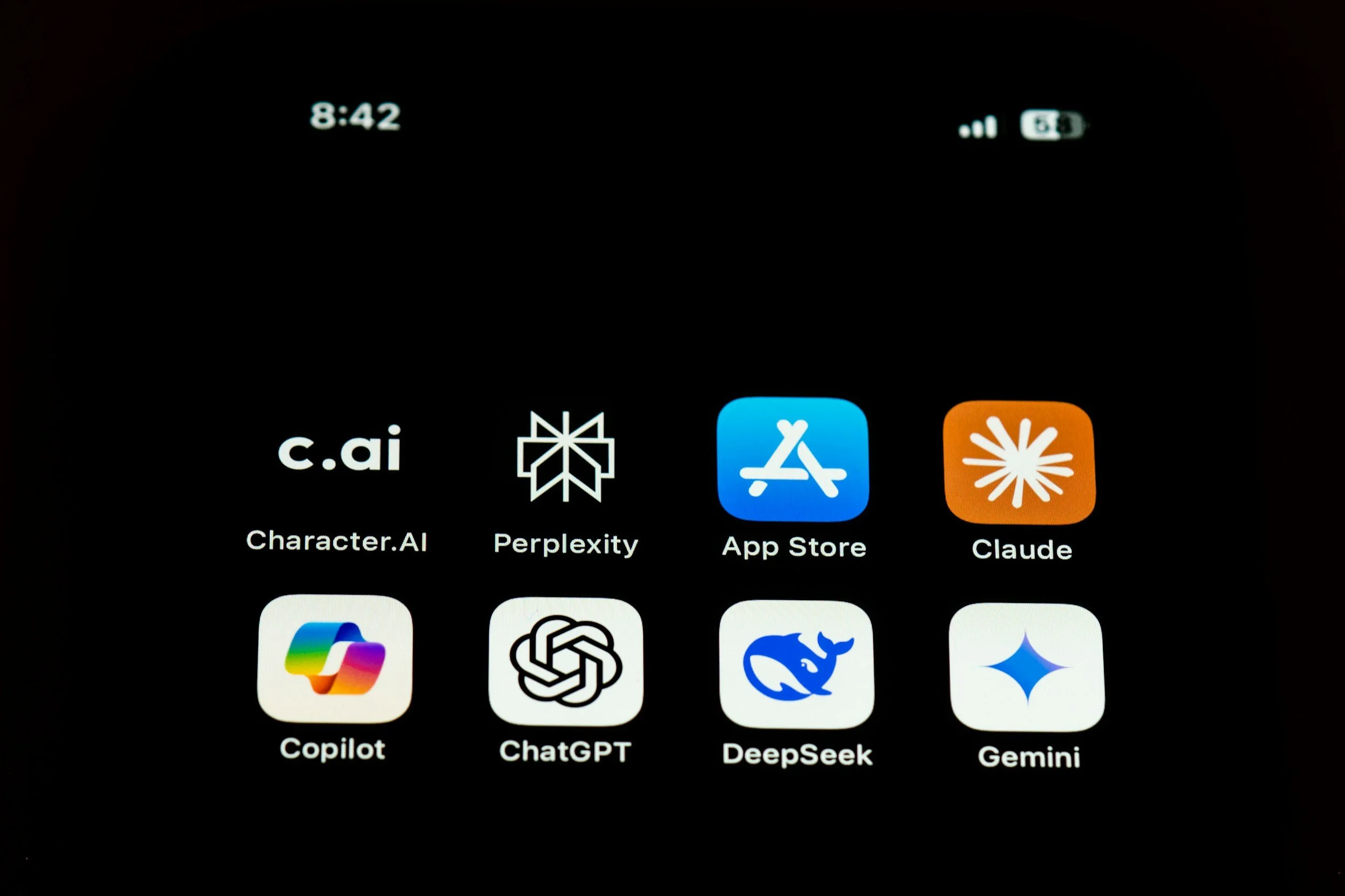

When Microsoft Copilot became available last year, we saw an opportunity—not just to experiment with AI, but to integrate it meaningfully into our workflows. Since then, we’ve embedded AI into our processes across the company, from underwriting and loan servicing to investor communications and compliance reviews.

But one area where we felt AI could be a valuable tool is in due diligence.

There’s been a lot of discussion in one of the investor forums we’re part of about using AI to perform due diligence on private investment funds. We’ve read the commentary, and we agree: AI has the potential to help investors ask sharper questions and make more informed decisions.

So we decided to take it a step further.