The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 3

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 10

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 8

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

Schedule K-1 and Form 1099. What, Why, Who, and How?

Laying a Strong Foundation for Investment Success: Insights on Navigating Due Diligence

In a recent episode of The Real Estate Vibe Show, Chris had the opportunity to sit down with Vinki Loomba to discuss one of the most crucial aspects of investing: due diligence. Whether you're investing in private debt, real estate, or other alternative investments, the success of your portfolio depends on your ability to thoroughly evaluate the risks and opportunities that come with each deal.

Unlocking the Power of a Self-Directed 401(k)

As an investor, you’re likely always on the lookout for innovative ways to grow and protect your wealth. However, there’s one powerful tool that remains relatively underutilized—the self-directed 401(k). In a recent interview with Matthew Brauer from eQRP, we explored the many advantages of utilizing this retirement vehicle for those looking to take greater control of their retirement funds.

Understanding the Advantages of the Kirkland Income Fund Sub-REIT

At Kirkland Capital Group, our foundational ethos is centered around being investor focused. This principle guided us in constructing our fund to prioritize our investors' best interests, ensuring that our fees, expenses, compliance, and operations are all in alignment with their needs. Consequently, we have adopted a Sub-REIT structure as part of our strategy to maximize returns and provide tax benefits to our qualified investors.

Why Savvy Investors Should Consider Private Debt in Real Estate

In an investment landscape that often feels like a tug-of-war between risk and reward, private debt in real estate offers a unique opportunity for investors to achieve stability and high returns. For those looking to diversify beyond traditional equities and bonds, private debt in real estate provides an intriguing opportunity. This was the focus of Chris and Brock's discussion as they guested on the eQRP podcast, hosted by Matthew Brauer, a platform that offers a self-directed retirement plan allowing individuals to invest in a wide range of assets.

Unlocking Opportunities: The Kirkland Capital Group's Strategy for Niche Commercial Real Estate Loans

Join our founders, Chris Carlsey and Brock Freeman, as they discuss KCG's investment strategies, risk management techniques, and the importance of transparency with investors. This is perfect for anyone interested in real estate and private debt funds.

The Importance of Consistent and Stable Returns in Fixed Income Investments

In the vast landscape of investment options, income funds have carved out a significant niche for themselves. Designed to provide a steady income stream to investors, these funds are often comprised of a variety of income-generating assets such as bonds, dividend-paying stocks, and real estate related investments. They play a crucial role in a well-diversified portfolio, particularly for those investors seeking regular income, or those looking for a more conservative investment strategy.

The Unbankable Deal: A Conversation with Malcolm Turner

I recently had the privilege of interviewing Malcolm Turner, the CEO and President of Castle Commercial Capital. He is a pillar in Detroit and has done numerous deals with us at Kirkland Capital Group. He is also an author of the book, Financing the Unbankable Deal: How to Buy Commercial Real Estate with the Bridge Loan Investor Success Strategy. In this fireside chat, we talk about his background, how he started his company, why a lot of investors are looking at Detroit, what are the trends he is seeing in real estate, his strategies when looking at real estate, and a lot more. You wouldn’t want to miss this video!

Private Credit: Unlocking Profitable Investment Opportunities

Private credit, a form of credit extended by asset managers to corporate and individual borrowers, has emerged as a high-performing alternative investment in recent years. Preqin estimates that the private credit market has grown from $250 billion in 2010 to $1.4 trillion in 2023. J.P. Morgan recently published an article entitled, “Can Private Credit Continue to Perform?”. It's worth taking a closer look at the key points in this article and see how they connect with our strategy at Kirkland Capital Group (KCG).

Commercial Real Estate Foreclosure in Judicial Foreclosure States: What Options Does a Lender Have?

At Kirkland Capital Group, we carefully review every loan through our due diligence process. Most loans that are submitted do not meet our standards. However, despite our proactive approach, there is still a possibility of foreclosure or property takeover. Our main priority throughout the entire process, including due diligence, loan servicing, and, if needed, foreclosure or property takeover, is to protect investor principal.

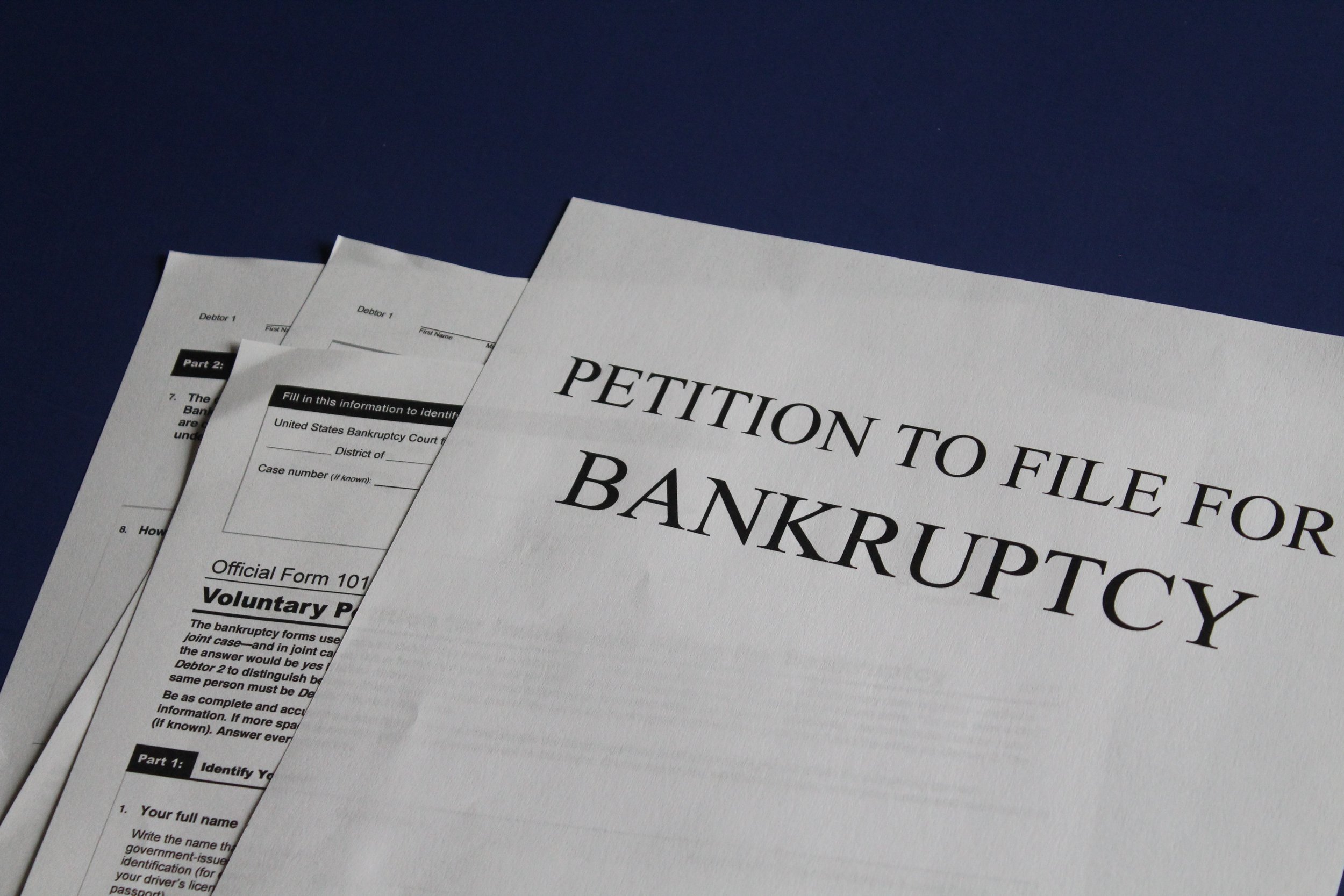

PeerStreet Lending Platform Failure

This has been a tough and unexpected market for many in private lending. When cheap capital dries up, operations that are not sound and are run by inexperienced management are sure to fail. Recently, PeerStreet, a Fintech platform offering private debt for real estate, filed for Chapter 11 Bankruptcy. They claimed to be the "first accessible distressed-debt investment platform," but their portfolio consisted of many other forms of loans. They acted as a broker, sourcing loans and matching them with lenders and investors on their platform, and maintained servicing in-house.