The latest.

Topic

- 1031 Exchange 1

- 401k 1

- Accounting 1

- Accredited Investors 4

- Active Real Estate Investment 5

- Alpha 2

- Alternative Investements 11

- Alternative Investment 1

- Alternative Investment Fund 2

- Alternative Investments 50

- Altigo 1

- Alto IRA 1

- Artificial Intelligence 1

- Auditors 1

- Background Checks 1

- Banking Collapse 1

- Bankruptcy 1

- Bar 1

- Bitcoin 1

- Blue Vault 1

- Bonds 7

- Bridge Loan 9

- Broker‑Dealer Standards 1

- CAASA 1

- CAIA 5

- CMBS 1

- Canopy Phoenix 1

- Capital Gains 1

- Commercial Real Estate 25

- Concreit 1

- Correlation 3

- Counterparties 1

- Credit Crunch 1

- CrowdStreet 2

- Cryptocurrency 1

- Debt Cliff 1

- Debt Structure 1

- Digital Assets 1

- Diversification 2

- Due Diligence 25

- Due Diligence Checklist 1

- Edge 2

- Education 14

- Emerging Managers 1

- Equity 3

- Ethereum 1

- Family Office 2

- Fed 1

- Finance 1

- Fixed Income 9

Access Our Exclusive Investment Insights.

What Sets Kirkland Capital Group Apart?

Kirkland Capital Group (KCG) is an investment fund manager combining 75+ years of investment management, real estate, and technology experience to Build and Fortify Your Wealth. Our principal preservation focused income fund generates passive high-yield income, delivering over 11% compounded net return for 2022 and 2023. Investors feel happy they capture strong returns, and are doing good, as the Fund’s micro-balance real estate loans are used to rehabilitate middle-income affordable housing and neighborhoods, making a positive social and environmental impact.

But how does KCG distinguish itself from the other income funds in the market?

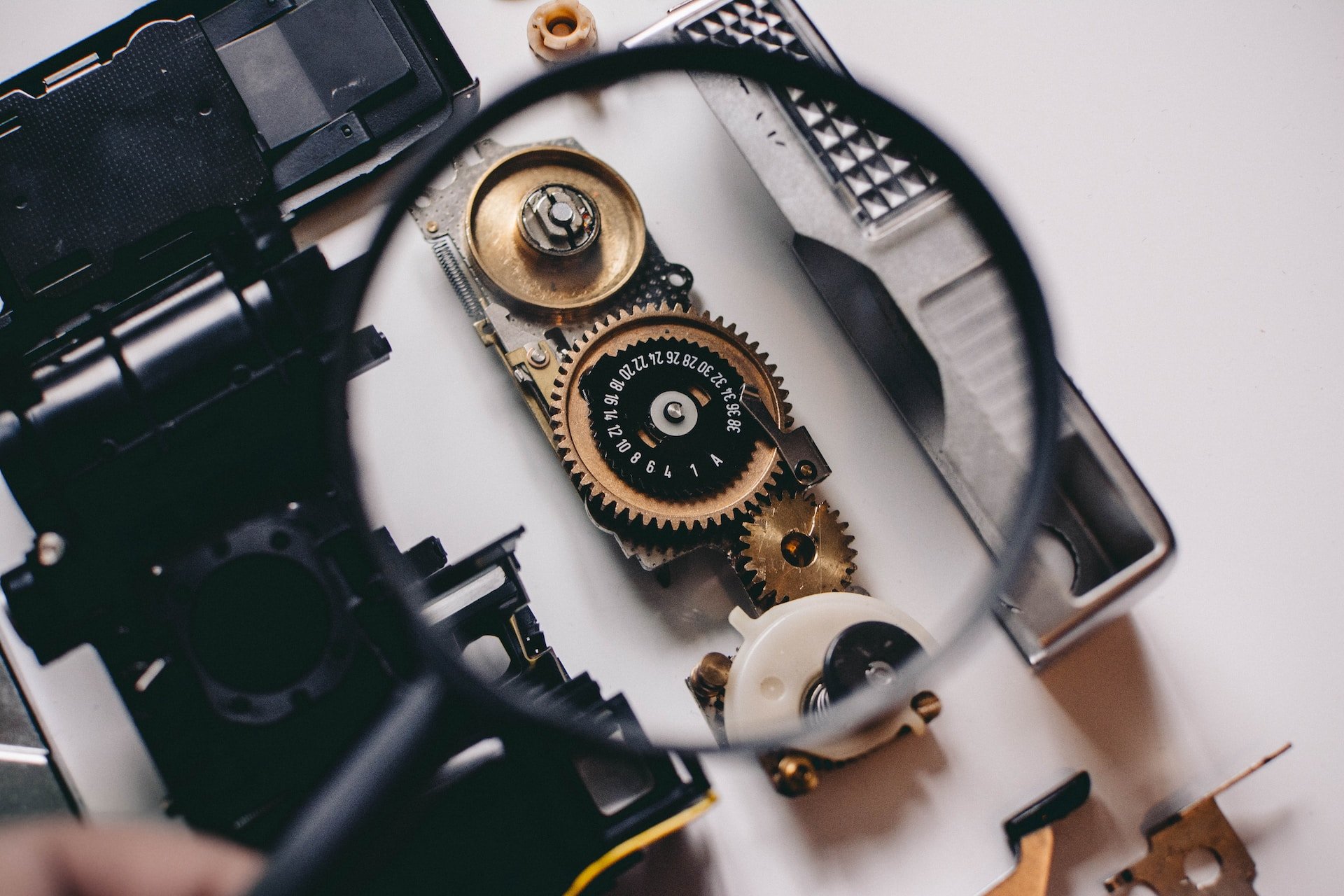

How Kirkland Capital Group Ensures Transparent and Accurate Monthly Investor Statements

To ensure accurate monthly account statements for investors in the Kirkland Income Fund, we carry out a monthly reconciliation process with our fund administrator. It involves more than just a few clicks on the keyboard. Let's take a closer look.