The Value of Skilled Management in Private Investments

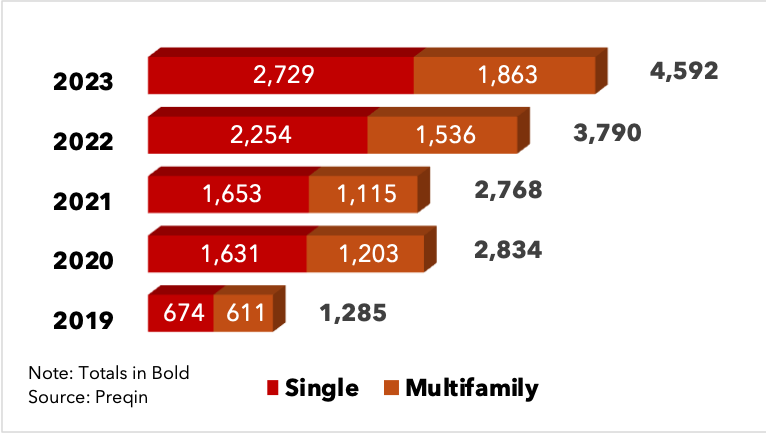

The family office sector has seen a remarkable expansion, with the number of family offices more than tripled between 2019 and 2023 according to Preqin. In 2024, it is estimated that Family Offices manage $10 trillion globally, highlighting the significant wealth concentration within these establishments.

Number of Single and Multifamily Office per Year

In recent years, there has been a noticeable trend among Family Offices towards favoring direct investments over conventional investment funds. This change is primarily driven by a desire to avoid the fees associated with fund investments, such as management and incentive fees.

Number of Family Offices with Direct Investments

Source: Citibank Global Family Office Report

While this strategy has yielded a mix of successes and obstacles, the dynamics are evolving, particularly in the spheres of real estate and private equity investments. The intricate and swiftly changing market conditions emphasize the importance of skilled management. This changing landscape offers a chance to reassess the dialogue surrounding the equilibrium between fees and the expertise that these fees support, especially in tumultuous times.

The reluctance to invest in funds often stems from concerns about transparency and the fees charged by these funds. While the desire for transparency is both understandable and necessary, it can be achieved in the fund investment world via requirements of trade level detail, audits, and separately managed accounts. The perspective on fees warrants a deeper examination. Investing directly to save on fees can seem like a prudent choice during stable or booming market conditions to generate better returns.

“In times of upheaval and market volatility, like the real estate market in 2023 and 2024, marked by 2022’s sharp increase in interest rates, the potential costs of forgoing professional and experienced management has been highlighted. ”

Yet, in times of upheaval and market volatility, like the real estate market in 2023 and 2024, marked by 2022’s sharp increase in interest rates, the potential costs of forgoing professional and experienced management has been highlighted. Many Family Offices have seen their direct real estate investments suffer, not due to the asset class itself, but due to the lack of adaptive management that could navigate the rapidly changing financial landscape.

This brings us to an essential realization: fees paid to investment funds are not merely for the sake of investment but for access to a team of experts who dedicate their time and expertise to managing and protecting your investments through all market conditions.

According to Campden Wealth, a key finding for the more successful family offices is, “Many of the family offices we surveyed revealed a proactive shift in their investment focus towards alternative asset classes in an effort to hedge against inflation. These strategic decisions by FOs and the savvy recommendations of their external investment managers have clearly played a crucial role in their ability to weather the storm.”

“Many of the family offices we surveyed revealed a proactive shift in their investment focus towards alternative asset classes in an effort to hedge against inflation. These strategic decisions by FOs and the savvy recommendations of their external investment managers have clearly played a crucial role in their ability to weather the storm.”

In essence, investors can either choose to pay fees upfront for professional management, or potentially pay those fees indirectly through losses incurred from less informed or less nimble investment decisions. We have conducted webinars discussing ways to recognize manager edge and market inefficiencies, enabling you to pinpoint managers who truly justify their fees. One such educational content is our webinar on "How to Identify Market Inefficiency and Manager Edge".

Looking forward to 2025 and 2026, the real estate outlook maintains a cautiously optimistic stance, with notable intricacies varying by sector and location. The real estate landscape is displaying adaptations to the evolving norms of elevated interest rates, with segments such as multifamily investments retaining appeal amid persistent housing scarcities in numerous areas. Nevertheless, the terrain has unquestionably grown more intricate, calling for a series of tactical strategy changes coupled with a strategic investment approach and an experienced management team that can handle dynamic shifts in the market that could affect investments adversely. This is reflected in real estate having the second highest bearish sentiment for family offices after crypto assets for 2024.

Family Office Asset Class Sentiment for 2024

Source: Citibank Global Family Office Report

Family Offices find themselves at a critical juncture as they prepare for the largest wealth transfer in history from baby boomers to their children. The focus is now on refining investment strategies to achieve both growth and wealth preservation. Real estate, being the second-largest asset class for Family Offices, continues to play a vital role in these strategies. Nevertheless, the current obstacles have highlighted the importance of collaborating with professionals who offer the expertise and flexibility required to navigate unpredictable markets.

It's evident that we are merely scratching the surface in comprehending and adjusting to the changing dynamics of Family Office investments’ process and procedure. The transition towards acknowledging the importance of proficient management, despite the associated expenses, signifies a noteworthy advancement in the strategic methods of safeguarding and expanding family wealth in the present moment.

The experiences of family offices offer a crucial lesson for individual investors, emphasizing the importance of investing in expertise. Paying fees for fund investments is not merely an expense but a strategic investment in professional knowledge that equips portfolios to navigate market volatility more effectively. It is also valuable for people who do not have the time nor skill/team to run investments effectively.

“The experiences of family offices offer a crucial lesson for individual investors, emphasizing the importance of investing in expertise.”

While the temptation to save on fees during stable economic periods is understandable, the true value of expert fund management becomes unmistakably clear during market downturns. Such expertise not only protects investments from potential losses but also positions them for growth during market recoveries. Hence, by adopting strategies from family offices, individual investors are encouraged to prioritize long-term security and growth potential by entrusting their assets to experienced fund managers, viewing the fees as an investment in future stability and success.

If you want to discuss this topic further, feel free to contact me at chriscarsley@kirklandcapitalgroup.com.